Canadian Fintech: Funding Falls Fast 📉

Bank sells fintech. BDC goes all in on ESG. New ID verification regs & products.

Morning!

Welcome back to Canadian Fintech, a newsletter for founders, operators & VCs. Was this forwarded to you? Become one of our 6,663 subscribers by clicking below.

💰 Funding

Goose Insurance, a mobile-app for finding and purchasing consumer insurance products raised $4m. PolicyMe, PolicyAdvisor and Emma also compete in the online insurance brokerage space.

Uplinq, an adjudication software for small business lenders, raised $600k. Edmonton based Trust Science offers a similar service on the consumer side.

BOXX Insurance, a small business cyber insurance company raised $19m. The insurtech acquired cyber threat alert startup Templarbit last year.

Consumer lender Propel Holdings raised a $250m credit facility for one of its US lending brands. The company launched Fora Credit, its first Canadian direct lending brand last year.

🤝 M&A

National Bank is selling its in-house financial planning software to CGI, a large IT consulting vendor of the bank. Why?

Although it is unusual for a vendor to acquire IP from a client, my guess is that the capex needed to maintain and enhance a home grown solution wasn’t worth the marginal savings in licensing fees. By consolidating their software into CGI’s, now National can use a single platform and not have to worry about integration costs and system upgrades.

Equisoft, a financial advisor platform, is acquiring CompuOffice, an insurance research software. Why?

CompuOffice’s research product fits in well with Equisoft’s suite of advisor tools (CRM, financial planning, proposal, etc.) It also lets Equisoft cross sell CompuOffice’s 28 carriers and 250 MGAs.

Desjardins is shutting down its real estate brokerage FairSquare, three years after acquiring it for $60m. Yikes. Why?

Desjardins acquired the brokerage at Canada’s real estate peak. Today’s high rates have created a lul in the home sale market, meaning brokers are pulling in significantly less.

🚀 Product

Laurentian Bank launched a new credit card program via Brim.

Brim allows banks to outsource everything related to running a card program (issuing the cards, building a loyalty points program, expense tracking, etc.) while keeping their brand on the plastic.

BDC, a crown corp and Canada's largest investor in VC funds, will start collecting ESG data from the funds they invest in, and their subsequent portfolios.

BDC’s $20b in independent VC fund investment represents 62% of all venture capital in Canada. This means that overnight, the majority of Canadian ventures will be expected to report ESG data.

Plaid launched two digital ID solutions in Canada. Monitor (AML) and Identity Verification (KYC via selfies & gov issued ID scans).

No surprise here as Plaid acquired Cognito, an ID verification startup last year. This move puts Plaid in competition with platforms like Onfido and Yoti. Plaid’s advantage here is seamless integration between their bank verification product and ID verification products.

RCCAQ, Quebec’s insurance broker association, launched an online quote marketplace called Demano, to compete with emerging digital brokers (scroll up). 4 carriers and 12 provincial brokerages are participating. Is it common for trade groups to launch businesses?

Canadian Lenders Association launched their own fraud consortium called Lenders API.

Équité Association launched a similar fraud bureau for Ontario auto insurers.

Sponsored by Xero

A tale as old as tax season 👴

It’s tax season – a.k.a., the time of year when many business owners spend late nights at their kitchen table, buried in receipts and scrambling to catch up on a year’s worth of bookkeeping.

If that sounds all too real, it’s time to embrace cloud accounting software in your business.

Xero accounting software can make tax time a breeze. Xero can enable you to connect to your bank to bring in your business transactions, snap photos and securely store your receipts, and provide your accountant with access to the financial data they need to see.

Even better – Xero connects with 1,000+ apps, so you can seamlessly and securely transfer data between the fintech tools you love.

Get 50% off select Xero plans for 6 months when you sign up before March 30. Use code TAXTIME2023 at checkout – sign up here.*

(No time to set up and learn how to use Xero? No sweat – Xero has teamed up with huumans, who can provide free setup and onboarding services for new Xero users. Learn more here.)

*Terms apply – see here for details.

⚖️ Policy

Like the CFPB in the US, the FCAC, Canada’s federal consumer finance watchdog, has been examining BNPL. The FCAC has been gathering information via public surveys and consumer interviews since 2021.

Revisions to Canada’s Anti Money Laundering / Terrorist Financing Act were published last week and stakeholders will now have a 30-day consultation period to respond.

The big change is that mortgage lending entities (lenders, brokers & administrators) will become subject to the act.

FINTRAC has updated its guidance on methods to verify a person’s identity.

It now provides clear direction on how banks and credit unions can verify the identity of a victim of human trafficking or domestic abuse, when that victim may not have proper identification docs to open a retail deposit account.

🎂 Number time!

52% - Canadian restaurateurs that say their staff receive fewer tips when customers pay using contactless payment methods.

81% - the percentage of Canadian immigrants whose first financial product is a credit card.

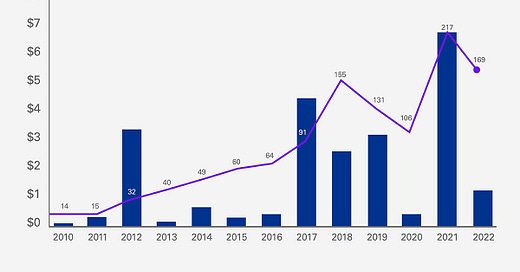

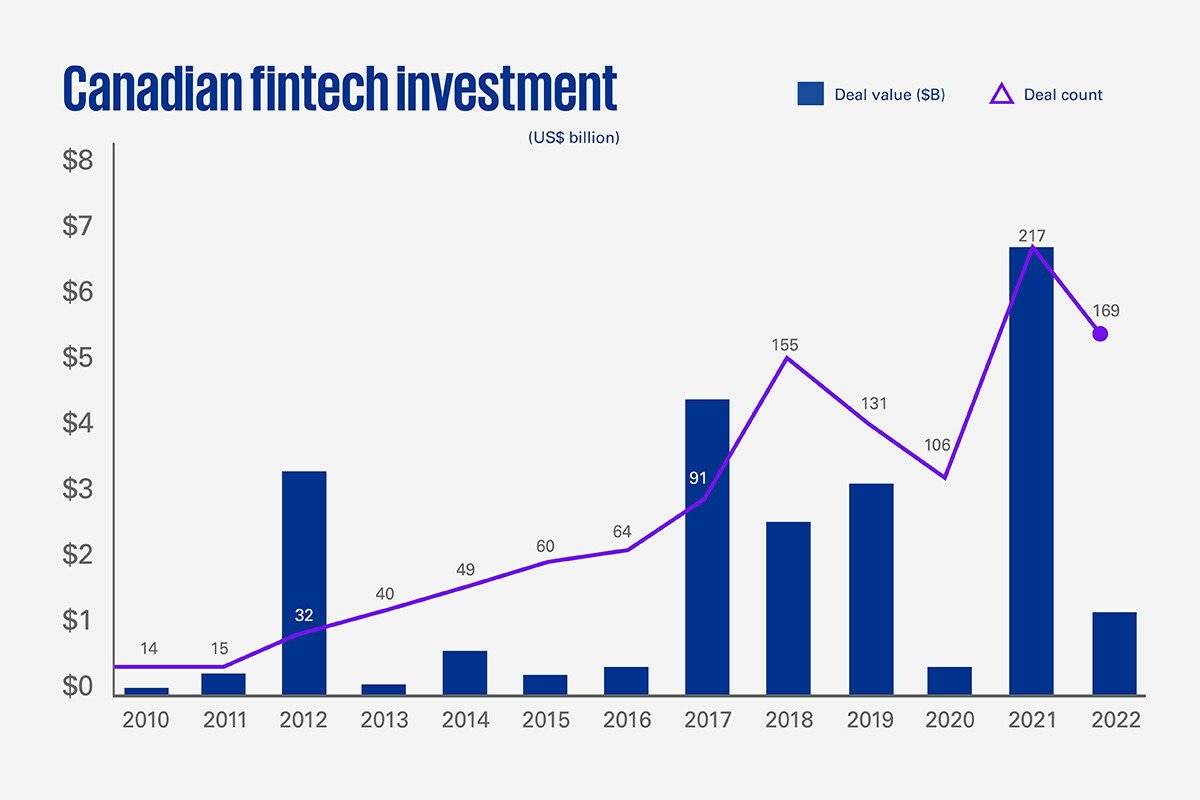

$6b - the drop in VC funding to Canadian fintechs from 2021 to 2022 (see chart).

Have a great week! See ya 👋

Interested in sponsoring? Reply to this email.