Canadian Fintech: I-bankers peace out ✌️

Crypto exchange rollup. GICs are sexy again. ChatGPT for finance.

Morning!

Welcome back to Canadian Fintech, a newsletter for founders, operators & VCs. Was this forwarded to you? Become one of our 6,928 subscribers by clicking below.

💰 Funding

Yield Exchange, raised $700k to help Canadian orgs (municipalities, endowments, etc.) browse and negotiate GICs across multiple financial institutions (banks, trusts, CUs). Think of it as a marketplace between orgs (depositors) and FIs (GIC providers).

Deposits are sexy again in an era of bank runs and high interest rates. Banks actually have to compete to win deposits now. Marketplaces like Yield Exchange can make that more efficient.

Certn, raised $40m to help employers run background checks (education, criminal history, past employment, etc).

Super, fka SnapTravel raised $115m to expand their discount e-com marketplace and launch a cash secured credit card. Super recently moved their HQ from Toronto to SF.

🤝 M&A

Wonderfi keeps rolling up crypto exchanges and now claims to be Canada’s largest regulated platform.

Last year the company acquired Coinberry for $38m and Bitbuy for $206m

You can add Coinsquare and Coinsmart to the list.

Zafin, a pricing platform for loans, has sold off FINCAD, a pricing platform for derivatives a year after buying it.

Ontario Teachers Pension Plan acquired what was Canada’s largest independent insurance brokerage, Westland Insurance. Westland made 26 acquisitions themselves last year.

🤑 Win $300,000 for your fintech startup!

Canada’s biggest fintech pitch competition is back! Apply for your chance to win $300,000 in cash prizes.

Along the way, you'll get exclusive access to pitch coaching, expert-led workshops, and world-class mentors.

Building a fintech startup? Apply before June 5th 👇

💸 Cut backs

International investment banks are pulling out of Canada, leaving a hole open for local boutique and big banks.

Lazard substantially downsized its Canadian team

UBS has been scaling back coverage for years

Deutsche Bank has also been trending in that direction for years, and recently made global cuts

Credit Suisse is expected to switch their focus to wealth after their merger with UBS

HSBC is also a question mark once the RBC acquisition settles

Billi, a personal finance management app that allowed Canadians to build credit, track carbon in their purchases, and manage bills has shut down.

🚀 Product

FinChat.io, ChatGPT for finance, hit 10k users on launch day. The explosively popular app is based in Toronto.

HonestDoor, a home estimation software, can now be embedded into third party sites, similar to Zestimates from Zillow.

Wealthsimple launched options trading, a staple feature of trading apps like Robinhood.

Vault, a fintech bank for businesses, now lets customers purchase GICs in-app.

Mindbridge, an AI tool for auditors to identify high risk transactions, scored a global deal with one of the world’s biggest - KPMG.

🎂 Number time!

$200 million - The cost per day of the public service workers strike according to Scotia economists. Good thing a tentative deal was reached for some strikers over the weekend.

$37 million - Losses TD suffered in a “cheque kiting” scam. How does that work?

A fraudster cashes a cheque into a bank account.

The bank conditionally releases the money, before the cheque clears.

The fraudster withdraws the cash.

And then quickly cancels the cheque, so the money never leaves.

… real-time payments anyone???

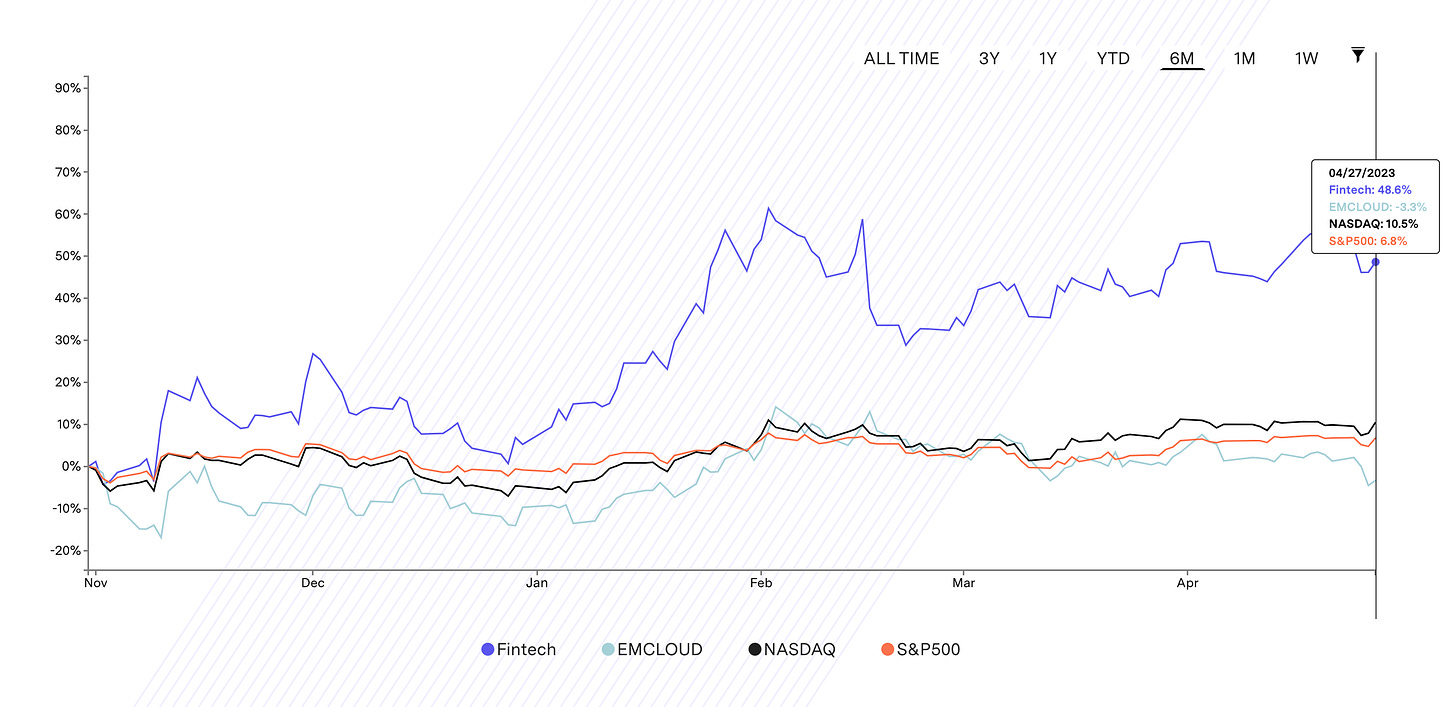

48% - The stock performance of public fintechs over the last 6 months, according to F-Prime. Not bad compared with the NASDAQ’s 10.5% (see chart).

PS if you’re in Toronto on May 17th, come say hi at the Bankers Summit. Need a discount code? Reply to this email.

PSS if you’re interested in sponsoring this newsletter, just reply to this email.

PSSS seriously don’t forget to apply to win $300k for your startup!

Have a great week! See ya 👋

Could you also cover the failed or filed for bankruptcies? There are a handful of those monthly in Canada.