Canadian Fintech: Embedded lending 🏗️

Challenger bank funding. Deposit insurance. VC secondary markets.

Morning!

Big news - we just hit 7,000 subscribers 🍾. Was this forwarded to you? Become one of them by clicking below.

💰 Funding

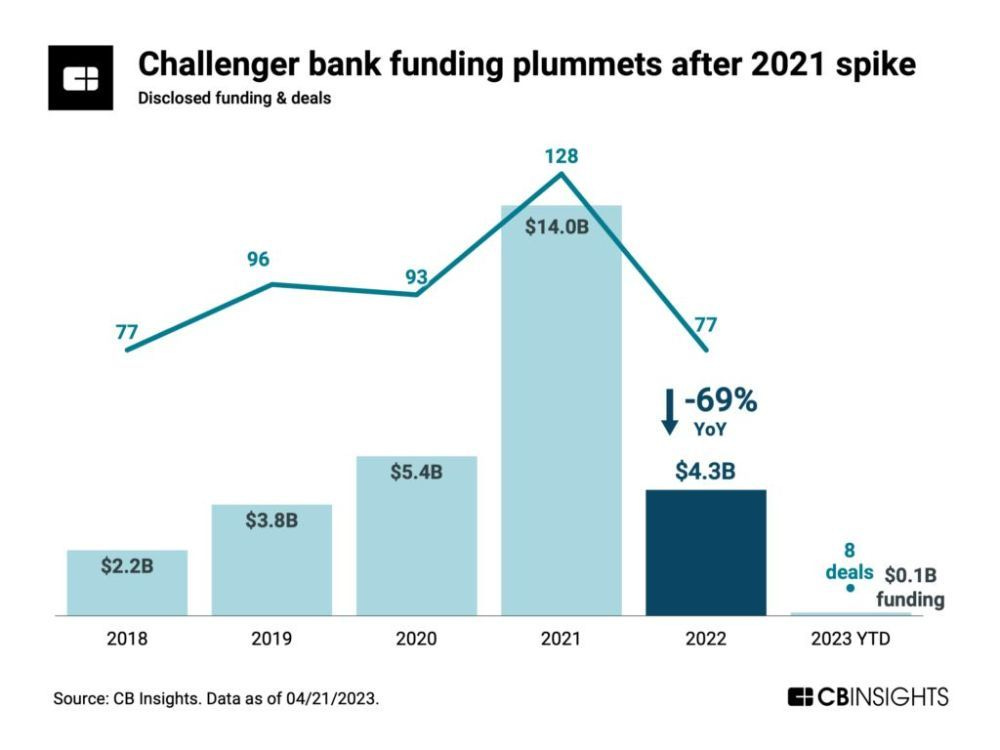

Vault, a challenger bank for businesses, raised $5m. This bucks a global fundraising trend (see below).

Bloom, a reverse mortgage lender, raised $7m. This is a loan designed for elderly homeowners to convert their equity into monthly cash income. Typically upon death, the estate repays the equity to the lender.

Tough Commerce, an e-com platform for the construction supplier industry, raised $2m. Canadian fintechs Toolbx and Shopify also compete in this market.

Plenty, a financial planning & investing platform for couples raised over $3m, launched by a Canadian founder.

🤝 M&A

GeoComply, a company that prevents location fraud, acquired OneComply, a company that helps regulated businesses monitor their licences. Why?

Because they both are from Vancouver and have super similar names…

Also because both companies service clients in highly regulated financial industries like sports betting and crypto. Location based verification is crucial in gambling, which is typically restricted to specific geographic spaces. But it is only one piece of compliance management. The new entity will enable compliance teams to apply for and monitor their licences.

🚀 Product

Wealthsimple has extended the CDIC coverage in their cash account from $100k to $300k. How do they do this?

The government insures eligible deposits per depositor per bank up to $100k. In other words, if Tal has $150k sitting in his CIBC account and the bank goes under, the government will send him $100k.

Wealthsimple is not a CDIC institution, so they partner with Schedule 1 Canadian banks that are. Wealthsimple spreads out the cash across three partner banks in order to provide 3 x $100k of coverage.

Everyone has become a mini expert on deposit insurance after SVB’s failure… so the timing of this feature is no accident.

Borrowell, a marketplace for loans, has partnered with Fig, an embedded online consumer lender. Why is this a big deal?

Loan marketplaces are lead generators for lenders. Here is the typical journey: Tal needs a loan, he goes to Borrowell, does a soft credit check, gets shown several loans that he is “pre-qualified” for, then picks one to initiate an application. IF the application is successful, Tal receives the loan and Borrowell receives a commission.

Problem: That’s a big IF. A “pre-approval” from Borrowell does not always mean approval from the lender. The borrower will still need to be underwritten by the lender after Borrowell hands them the lead. Even if Tal is approved, he may end up with a different rate than the one he saw in the app.

In a Borrowell + Fig world: Now when Tal looks for a loan on Borrowell, he can start an application and receive approval from Fig without leaving the Borrowell app.

I’ll write more about Fig and embedded lending in a later newsletter.

Hiive, a platform for buying and selling shares in private VC backed firms has launched in Canada after receiving its exempt market dealer licence.

The most common path to liquidity (turning stock into cash) for investors and employees is going public. Not a lot of that is happening right now. So Hiive’s secondary market for VC provides an alternative.

🎂 Number time!

#1 - Canada’s most trusted brand is Canadian Tire, a retail brand… with a bank licence and $6b in credit card receivables. Does that also make them Canada’s most trusted bank?

11% - the amount of Canadians who are real estate investors according to Royal LePage.

20% - the median increase in monthly mortgage payments over the next three years according to the Bank of Canada.

Have a great week! See ya 👋

Interested in sponsoring? Reply to this email.