Canadian Fintech: The History of Walmart Canada Bank 🧑🎓

Scotia sells card business back to Canadian Tire. Liberals are creating a new bank.

Morning!

Welcome back to Canadian Fintech, a newsletter for founders, operators & investors.

Existing subscriber? Please consider supporting this newsletter by upgrading to a paid subscription.

Was this forwarded to you? Become one of our 7,659 subscribers by clicking below.

💰 Funding

QuoteMachine, raised $5m to let merchants manage quotes, orders, inventory and payments.

Arteria AI raised $46m to help banks produce, manage and analyse customer contracts. The company spunout of Deloitte in 2020.

PADS Financial, raised $3m to launch an online home equity lending business.

🤝 M&A

Canadian Tire now fully owns its credit card business after buying out Scotiabank for $895m. Scotia purchased 20% of their business for $500m in 2014. My take: this is ideal for both parties.

Scotia wants to cut costs, as rates go up and consumer spending slows.

Canadian Tire wants to invest more in financial services. They drive 29% of profits from financial services including their paid loyalty program and credit card unit, which is the 7th largest issuer in Canada by outstanding receivables.

Public equities research platform Stratosphere is merging with FinChat, a similar platform built on GPT3. Both products already have the same owners.

✌️ Peace of Mind for CFOs

So you raised debt capital for your lending company - bravo! Now for the nuts and bolts: making sure you can access the capital when you need it. That’s where Finley’s debt capital software comes in.

Finley fosters a CFO’s peace of mind by simplifying credit facility management. From streamlining funding requests to tracking covenant compliance, Finley’s software helps teams automate crucial financial processes.

CFOs already using Finley manage over $3b in debt capital with private credit lenders and rest easy while doing it. And now, Canadian Fintech Newsletter readers can get a $100 gift card just for chatting with a Finley expert.

Don’t miss out. Register here.

🚀 Product

Walmart Canada partnered with BNPL Klarna. Why? First a quick history lesson:

In 2009 Walmart Canada received a Canadian banking licence, which it used to issue its own credit cards.

Despite it being profitable, Walmart sold the banking business in 2018 to Stephen Smith, who rebranded it as Duo Bank.

Duo then bought Fairstone in 2020, who continues to issue all of Walmart Canada’s cards.

In 2021 Walmart global launched / acquired its own neo-bank called ONE, which has said that it will launch BNPL as part of its fintech offering.

So why did Walmart Canada partner with Klarna? Because history has shown that their Canadian business prefers to partner rather than own financial services.

Will Walmart Canada eventually go back to owning their own financial products (cards & BNPL)? Possibly. Fintech regulation forces global companies to think regionally, so I don’t see this happening for years.

Iceberg Finance hit $1b in loans extended. The auto lender expanded into medical financing with their 2022 acquisition of iFinance.

Liberals are planning to launch a $3b Ontario Infrastructure Bank to incentivize pension funds to invest locally in nursing homes and municipal projects that the province cannot afford to build. Conservatives have been promising to dismantle the Canadian Infrastructure Bank, since it was established in 2017.

⚖️ Policy

The Ontario gov has expressed support for open banking and payments modernization. Awesome but… both of these are legislated at the federal level.

📈 Stat of the week

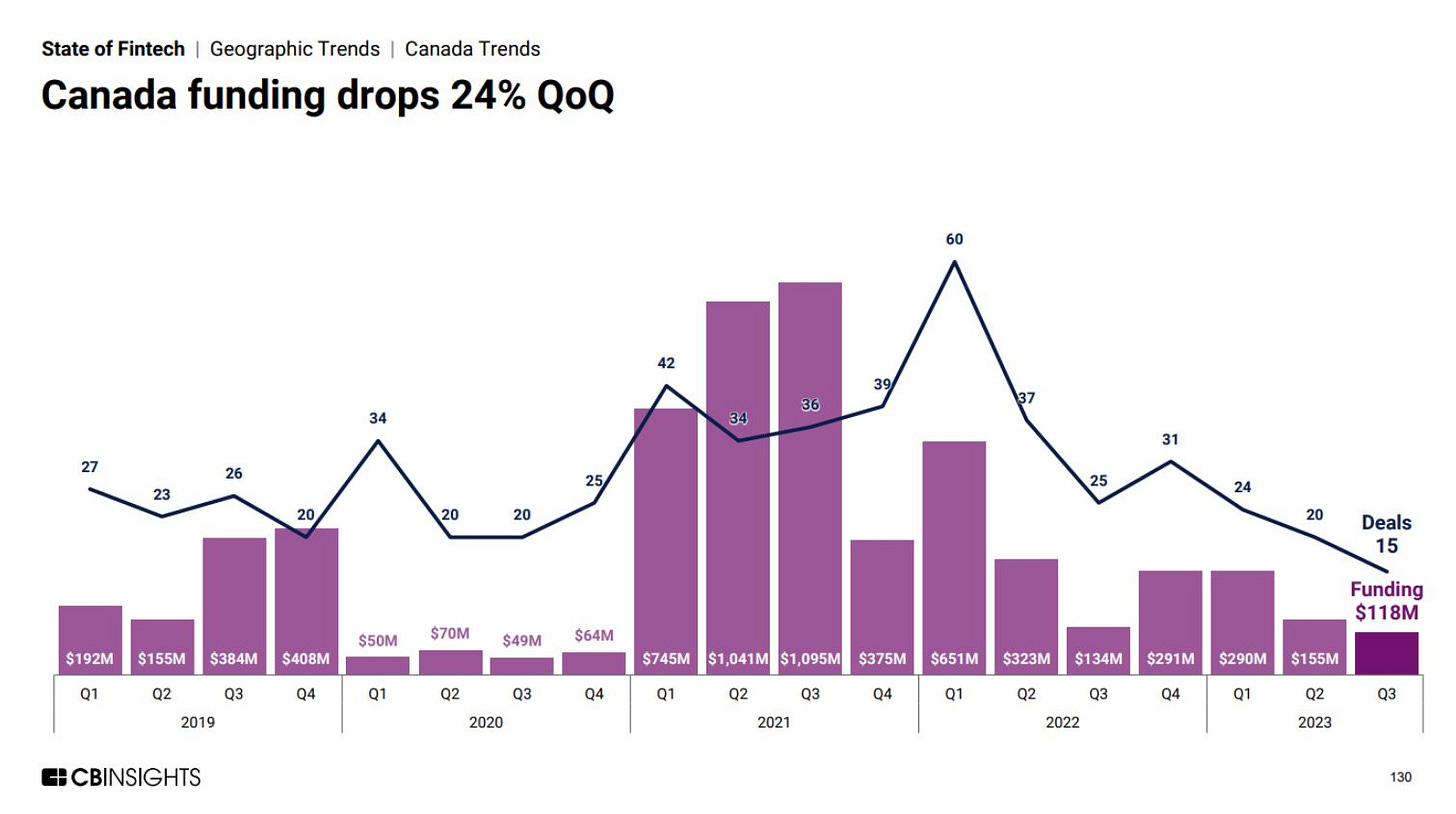

24% - the drop in overall Canadian fintech funding QoQ.

But it was late stage funding that got squeezed the hardest. Over the last 5 years 7.5% of total deals were late stage. This year it's 1%.

Raising money? Get your deck in front of hundreds of investors here.

Investing? I’ll send you curated fintech deals every week here.

Interested in sponsoring? Reply to this email.

Have a great week! See ya 👋