Canadian Fintech: Risky Business ⚖️

Loyalty points blockbuster deal. Earned wage access. Buying up tools for financial advisors.

Morning!

Welcome back to Canadian Fintech, an industry recap with an uncreative name! If you're reading this and haven't signed up, join the 4,856 others by clicking below. Thanks!

💰 Funding

Online used car dealership Clutch secured $150m in debt to expand its inventory and start offering its own auto financing. CanadaDrives is the other digital challenger in this space taking market share from physical dealerships.

Moves, the neo-bank for gig workers (that I wrote previously about here) closed $6m. The fintech offers a spending account, loans, and rewards for workers on Uber, Doordash, and other gig platforms.

HR & payroll platform Humi put together a $31m Series B. The company has hinted that it is expanding into earned wage access (EWA), a loan product that lets employees get paid for the hours they’ve worked, instead of waiting the typical two week pay cycle. This would put them in competition with Ceridian’s Dayforce Wallet and ZayZoon. I expect to see EWA become table stakes for all payroll providers like Deel, Rise People and Collage (acquired by People Corp) in the Canadian market.

🤝 Acquisitions

Plusgrade is acquiring Points.com for $519m in a blockbuster Canadian loyalty points deal. As travel returns, loyalty programs for cruise, air, and train are expected to perform well.

Online small business lender OnDeck Canada is now… Canadian after completing a management buyout from US parent company Enova. What’s the history here? Montreal based lender Evolocity was acquired in 2019 by OnDeck, a pioneer in the smb lending space. OnDeck was then itself acquired mid-pandemic by Enova, a fintech lender focused on subprime consumers. Now OnDeck Canada will keep the brand, but operate independently.

Canadian tools for financial advisors are getting consolidated:

Fortuna, a sales platform for financial advisors, was acquired by CyborgTech (all time best name for a software company).

AdvisorStream, a marketing solution for advisors was scooped up by Broadridge last year.

Wealthtech PureFacts, made two comparable acquisitions in 2020, then recently raised $37m to make more purchases this year.

🚀 Product

Dapper Labs’ NBA Top Shot, an NFT series on basketball highlights has hit $1 billion in sales after launching in October 2020. This announcement comes amid a huge drop in crypto prices.

Nuula, a free platform for small businesses to monitor their cash flow, credit score, and business reviews is rolling out a suite of third party services:

Insurance via Walnut

Investment via OneVest

Wellness via ClassPass & Headspace

Loop, a corporate card for e-com sellers that do business internationally is now available across Canada. Loop offers 55 day interest free spending (that’s very long), multi-currency accounts, and rewards. The company was launched by the same team as Lending Loop, Canada’s first P2P lender.

Merchants on Shopify and WooCommerce are now able to offer shoppers BNPL through Affirm. Affirm operates in Canada through its acquisition of local BNPL PayBright back in 2020. Shopify also owns 20m shares of Affirm.

CIBC and TD have partnered with Luma, a platform for financial advisors to source, structure, and present annuities to clients.

In partnership with Float

Know of any Big Big Spenders, Receipt Losers, or Corporate Card Sharers in your company? We bet you do. No matter who is spending, Float’s corporate card and spend management software can help.

With features like team management, SMS receipt collection and customizable card spend limits, Float helps Canadian companies manage business spending, effortlessly.

Learn more at www.floatcard.com

⚖️ Risky Business

In this week’s edition of things that Canadian regulators find risky, we have three standouts:

DeFi - FINTRAC, Canada’s AML watchdog, has decentralized finance (DeFi) in its crosshairs. The agency produced a report for law enforcement detailing how the sector is an increasing area of risk. The last federal budget pledged $90m to FINTRAC to deal with crypto. The government also promised an imminent regulatory review of the sector.

Climate Change - Federally regulated FIs (aka major insurers and banks) will soon be required to disclose how they are planning for “climate risk”. Scratching your head? As drought, floods, and fires become more frequent and severe in Canada, OSFI is worried that the financial sector that supports affected businesses and communities will also be impacted. Expect banks to publish measures on how they are reducing climate change related vulnerabilities in their business models. Climate risk is separate from ESG, which is a movement to have FIs reduce their carbon footprints by divesting from dirty energy projects for example. I wrote about it previously here.

Mortgage Debt - It’ll soon be harder to get that line of credit bundled with your mortgage. Combined mortgage-HELOC Loan Plans (CLP), is essentially a line of credit that increases as you pay off your mortgage. They have exploded in popularity over the last two years by 37%. Why is this a problem? Well, if you can borrow back every mortgage payment you make it's easy to get overloaded with debt.

🎂 It’s number time

10% In the last two weeks, BNPL company Klarna announced that it hit 150m users shortly after announcing that it will lay-off 10% of its workforce. It’s assumed that this will impact hiring for their new North American engineering hub based in Toronto.

4/5 The number of big banks that beat earnings thanks largely to strong commercial lending profits. Who missed? CIBC because of the costs to acquire Costco’s $3b credit card portfolio.

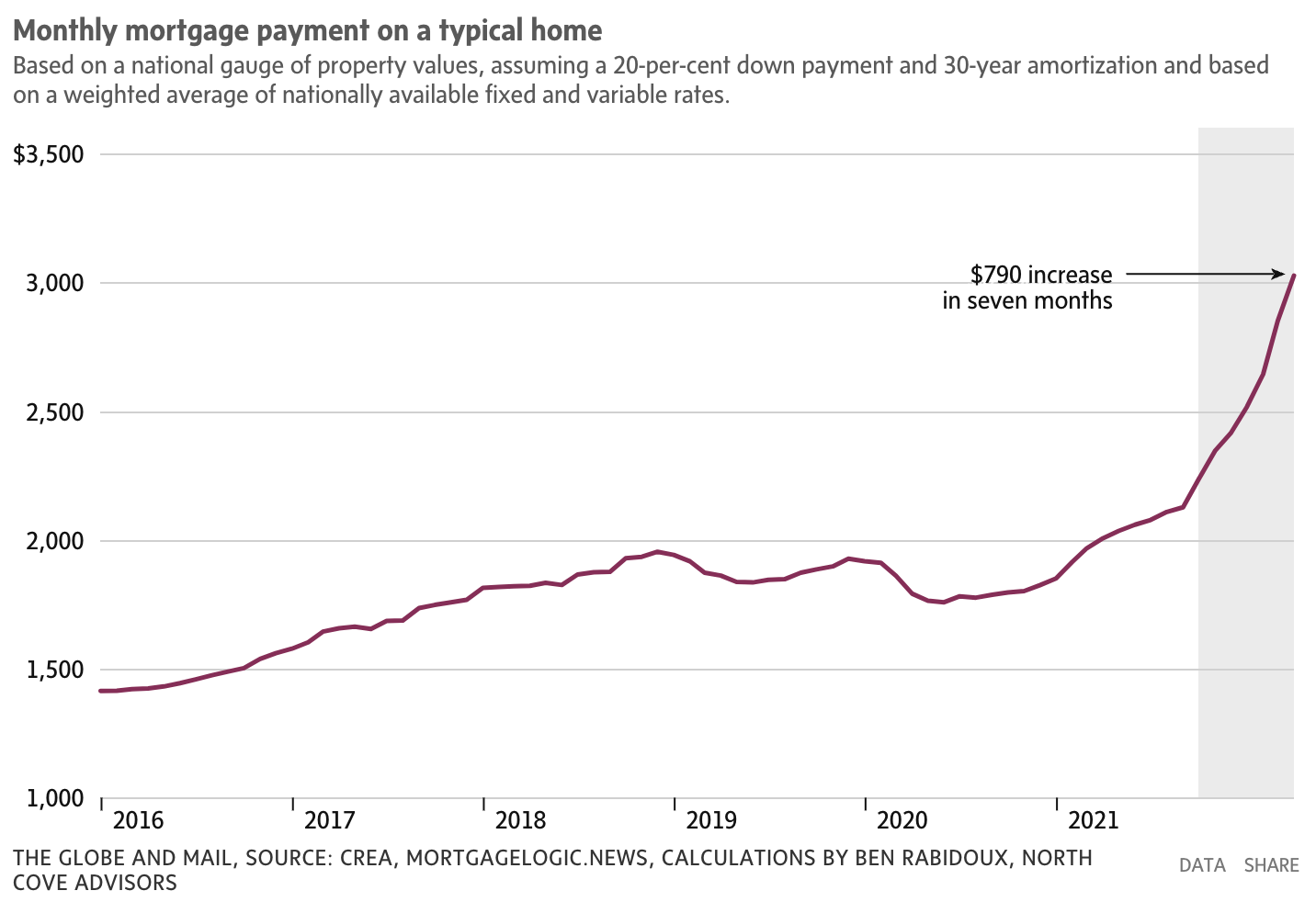

$800 the increase in monthly mortgage payments for the average Canadian home (see graph below)

👀 Who’s hiring?

Billi, Director of Engineering (Remote)

Cash App, Head of Compliance (Toronto)

Float, Product Manager, Accounting (Remote)

Neo, Director Strategic Partnerships (Calgary)

😇 Interested in sponsoring? Reply to this email.

🤓 Liked what you read? Forward it to a fintech friend.