Canadian Fintech: Telus Swipes Left on Swipe Fees 💳

Fintech sues real-estate associations. Canada gets another commercial bank. More fintech layoffs.

Morning!

Welcome back to the Canadian Fintech Newsletter, loved by all as much as Tobias Lütke loves newsboy caps (keep reading if you don’t get it). If you haven't signed up, join the 5,439 others by clicking below. Thanks!

💰 Funding

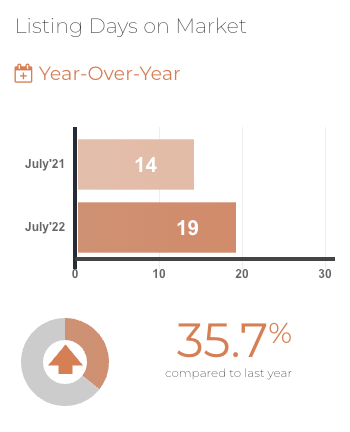

Properly, a fintech that lets you buy a new home before selling your existing one raised $36m. How does it work? Properly guarantees a sales price and sales date on your home, making it easier for you to get approved for a mortgage with another lender. If the house doesn’t sell in 90 days, Properly buys it for the guaranteed price and resells it on the market, giving back any profit to the original seller. But with rates increasing, homes have taken longer to sell (see graphic below). Properly has said they have had to purchase their client’s homes and expect this to continue.

Calgary based ZayZoon raised $25m to let employers offer their staff access to the wages they have already earned, without needing to wait the typical two week pay cycle. Canadian fintechs Koho and Bree also offer earned-wage-access products, but go directly to the borrower, not the employer.

Lending to… other lenders!

Equipment lender Pivotal Capital secured a $55m credit facility from Mitsubishi HC. In case you were also wondering: no this is not Mitsubishi’s captive auto finance arm, this is the merger of Mitsubishi and Hitachi Capital, two Japanese lessors. Pivot Capital is a subsidiary of Axis, a subprime auto lender.

Subprime consumer lender goeasy locked in a $500m securitization facility from National Bank, RBC, and BMO increasing their capacity to $1.4b.

🤝 Acquisitions

Canalyst, a data and analytics platform covering publicly listed companies, sold to Tegus for $450m, making it one of the largest deals in BC history.

Canadian banks are opening up their wallets:

🚀 Product

Moves, a card for gig-workers, now rewards spending with fractional stock in the public companies they work for (Uber, Doordash, etc.). This month, Uber launched their own card that rewards drivers up to 7% cash back on gas. I wrote previously about Moves here and here.

Major telco, Telus is adding a 1.5% surcharge to customers who pay with credit card. The fee is equivalent to the average interchange fee (the fee a merchant has to pay in order to accept the credit card payments aka swipe fee) in Canada. For context, European Union interchange fees are capped at 0.3%.

Citi is launching their Commercial Bank in Canada. The Schedule II bank has operated in some form in the country for over 100 years.

RouteOne, a service for auto dealers to submit loan applications to lenders has integrated with Paays, a pre-qualification platform for dealerships and OEMs.

Tap-to-pay is coming to Toronto public transit through a partnership between Visa and Metrolinx. Contactless payment has been available on Vancouver transit since 2018.

Sponsored by NETSOL

NETSOL has been proudly serving the global automotive and equipment finance and leasing industry for over four decades.

Our premier platform, NFS Ascent, is a proven, highly adaptive, and unrivalled modern technology solution available on the Cloud via flexible, subscription-based pricing, rapid deployment, and the ability to scale on demand.

Ascent covers Point-of-Sale, Origination and Servicing business processes.

💼 Layoffs come to Canadian fintech

It’s been a tough summer for many working in fintech. Several late stage employers have downsized their teams substantially:

Clearco 25%

Shopify 10%

Clutch 22%

Wealthsimple 13%

Why is this happening?

Increasing rates, the threat of an impending recession and a pause in venture capital has led fintechs to reduce burn.

Cutting expenses like staff and non-core initiatives gets these companies closer to profitability and extends their cash runway (how long a company can stay solvent without raising new funds).

A long enough runway will hopefully mean that they can wait it out until markets have improved. If not, they’ll be forced to raise money at a lower valuation than their previous funding round.

Klarna recently raised a downround at an 85% lower valuation.

🧑⚖️ Lawsuits

Unreserved, a real-estate auction platform trying to disrupt the traditional blind bidding process, has sued several Canadian real-estate associations for $25m in defamation damages. These groups are lobbying to remove Ontario’s 1950s regulatory exemption for real-estate auctions, a provision under which Unreserved operates. I wrote previously about Unreserved here.

A court ruling against the Montreal based operator of PornHub for profiting off of child pornography says that Visa may also be liable. Visa processes the company's ad and subscription payments.

Rogers and Coinsquare are pointing fingers at each other over $200k worth of bitcoin stolen in a SIM swap scam. The victim alleges in a lawsuit that a scammer failed Rogers’ account security tests but was still able to transfer the phone number to a different SIM. Rogers is now suing Coinsquare alleging that the exchange’s poor security is actually to blame.

🎂 Number time!

9.8% the growth of median after-tax household income from 2015 to 2020. Twice as much as the five year period before that.

7% the amount of multi-generation homes across Canada.

26 the average age of a Canadian in 1970. Today it is 41.

👀 Who’s hiring?

Neo, Senior Credit Risk Analyst (Calgary)

Symple Loans, Operations Manager (Toronto)

Simplii, Director Product Management (Toronto)

For those wondering what my intro was about…

Interested in sponsoring? Reply to this email or dm me here.