Canadian Fintech: Banks Say Open Sesame 🧞

M&A spree in the Prairies. Crypto finally regulated. Creators cash in.

Morning!

Welcome back to Canadian Fintech, your quick hit of fintech fun! If you're reading this and haven't signed up, join the 5,466 others by clicking below. Thanks!

💰 Funding

Montreal based insurance broker YouSet raised $2m. Unlike rate comparison sites RateHub, LowestRates.ca and Surex that focus on purchasing auto and home policies, YouSet also provides administrative services like policy modifications, renewals and communicating with the insurer. My thoughts:

Brokers in other industries (ex mortgages) crush it on renewals. They renew at way higher rates than direct lenders (banks) because they own the relationship with the client. The more present YouSet is throughout the life of policy, the more likely they’ll also make a commission on renewals and cross sells. Love this!

Toronto based Velocia, raised $2.5m to scale its commuter rewards program to more North American cities. Velocia partners with city transportation services (public transit, Uber, bike-share, scooter-share, etc.) to reward clean commuters with discounts on their next clean ride. My thoughts:

Cash back reward programs like Neo, Drop, and Ampli cast a wide net (ex. buy a couch get a discount on a coffee). Velocia is concentrating its rewards to a segment that is likely already environmentally conscious, which creates an opportunity to double down with other targeted financial products (financing eco-home improvement, credit cards that plant trees on purchases, etc.) similar to what eco focused neobank Aspiration does in the US.

NotaryPro raised $600k to take compliant signaturing online. Most financial transactions (wills, mortgages, auto loans, etc.) still require a wet signature, but Covid is pushing regulators to let them happen electronically:

BC recognized e-signatures on wills

Ontario recognized e-signatures for adding beneficiaries to registered retirement & savings accounts

🤝 Acquisitions

HR tech is piping hot… in the Canadian Prairies

Relay, a platform for cyber insurance brokers to create proposals, was acquired by At-Bay, a provider of cyber insurance.

🚀 Product

Canadian banks are opening up to a new flavour of Open Banking, a term to describe connecting bank account data to fintechs. This means moving away from “screen-scraping” (a method not controlled by the bank) towards APIs (private data networks between banks and fintechs that give more control to the bank):

National Bank acquired Flinks earlier this year and is also part of the Flinks network

EQ Bank joined the Flinks network

CIBC joined the MX network

RBC joined the Plaid & Yodlee networks

TD joined the Finicity & Akoya networks

BMO not part of any networks, recently created a direct integration to accounting platform Xero

Estate planning fintech ClearEstate has partnered with Bloom Finance to offer reverse mortgages. This is a loan designed for elderly homeowners to convert their equity into monthly cash income. Typically upon death, the estate repays the equity to the lender.

Shopify launched a marketplace to help their merchants find influencers.

Sponsored by Float

If you are looking for ways to further extend your company’s runway and tightly control cashflow, Float can help.

Float – a physical and virtual corporate card backed by powerful spend management software – gives you far more oversight over spending, while offering significant savings to your business.

Learn more and book a no-pressure chat with the team at www.floatcard.com

⚖️ Policy

Big banks are restricting their client’s access to high-interest-savings ETFs (high-interest cash accounts pooled across multiple banks), and instead are forcing them into bank owned products. Deja vu? Last year banks cut off client access to mutual funds not owned by the bank. An investigation is underway by IIROC and the CSA.

Payment fintechs will soon be regulated by the Bank of Canada, requiring them to register with the Bank, submit annual reports and potentially also get access to Canada’s much anticipated (and much delayed) Real-Time Rail system. 2000 fintechs are expected to be impacted.

Banks and insurers will soon need to notify OSFI (Canada’s largest financial regulator) if their exposure to crypto exceeds 1%. This is really the first significant crypto regulatory framework in the country.

🎂 Number time!

27.5 the average number of days Canadian small businesses wait for invoices to be paid.

40% the ratio of homes to new listings in Ontario, a level only seen once in the past 25 years (in the depths of the 2008 downturn).

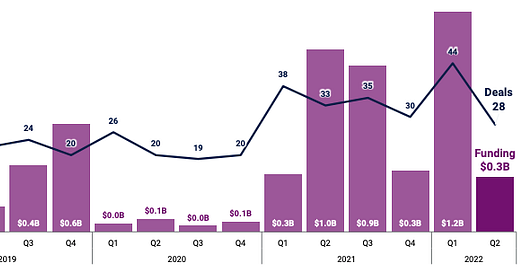

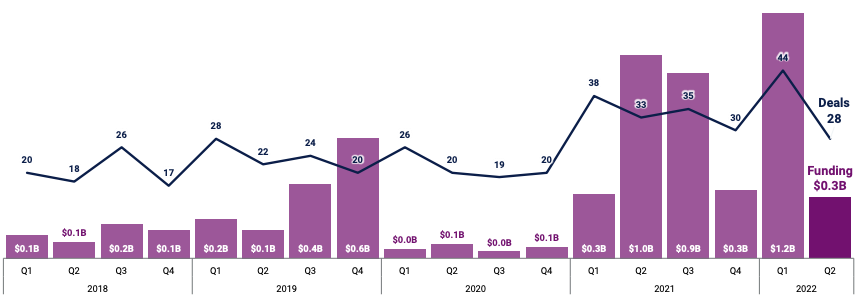

75% the drop in Canadian fintech funding from last quarter: $1.2b to $300m (see graphic).

👀 Who’s hiring?

Neo, Senior Credit Risk Analyst (Calgary)

Symple, Head of Technology (Toronto)

Float, Risk & Compliance Lead (Remote)

Interested in sponsoring? Reply to this email or dm me here.