Canadian Fintech: Alternative investing goes mainstream 🫘

Crypto deal falls apart. Introducing 2 new business banks. Layoffs accelerate.

Morning!

Welcome back to Canadian Fintech, the quickest way to stay up to date. Was this forwarded to you? Become one of our 6,557 subscribers by clicking below.

💰 Funding

Vancouver based blockchain company Blockstream raised $125m in debt to expand its bitcoin mining operation.

Notch, a platform for restaurants to manage orders, reconcile bills and invoices and process payments raised $10m. The company used to be called Chefhero.

🤝 M&A

Payments platform Nuvei has acquired US competitor Paya for $1.7b. Nuvei made similar acquisitions last year for payments companies in crypto and in sports gambling.

Crypto trading platform Coinsquare is backing out of a deal to acquire competitor Coinsmart in favour of a merger with publicly traded Wonderfi. Wonderfi recently acquired rivals Coinberry and Bitbuy.

Cross border payment company Ascendant was acquired in a PE deal.

Small business lender Merchant Growth has acquired embattled competitor Lendified. Merchant Growth also acquired rival Company Capital last year.

After suffering solvency issues, small business financial dashboard Nuula was acquired by Nav, a marketplace for finding business financing.

🚀 Product

Wealthsimple crossed the 3m customers mark.

Alternative investments like private equity and private credit used to be exclusively available to the rich. Now retail investors are getting access as well:

Canada has two new fintech business banks:

EQ Bank launched its own debit card, linked to their high interest savings account.

EQ attracts price sensitive clients through their market leading yields on GICs and savings accounts. But the challenge with servicing price shoppers is that they’ll leave if a competitor offers a better rate. A debit card with strong perks (cashback, fee waivers at atms, etc.) is EQ’s attempt at creating a sticky and high value banking experience, and hopefully also some customer loyalty.

Attend Canada’s largest bank & fintech conference

The Bankers Summit brings together 500 bankers and fintechs for a full day of networking and discussion. Come learn how traditional FIs are partnering with fintechs to build the bank of the future.

Use promocode CanadianFintechNewsletter for a 15% discount. Prices go up on Feb 1st.

💼 Layoffs

With rates rising and fintechs big push towards profitability, more layoffs have been announced:

Clearco (30%)

Shakepay (25%)

Canada Drives (undisclosed)

Clutch (65%)

Benevity (14%)

Lightspeed (10%)

If you’ve been affected, let me know if I can help intro you to folks in the Canadian Fintech Newsletter network.

⚖️ Policy

OSFI is tightening restrictions in mortgage lending. Borrowers will need to qualify under the higher of a) a stress test rate or b) the actual rate plus 2%. Why? Rates have risen 425 bps in a year putting borrowers at higher risk of default and variable rate holders into negative amortisation territory.

BC became the first province to require a 3 day cooling-off period for homebuyers. The protection is meant to give purchasers more time to arrange financing or do home inspections (often ignored in a hot real-estate market). Kind of a weird time to introduce this given that the market has already cooled off.

The BoC was the first central bank in a G10 economy to hint it was ready to pause further interest rate hikes, noting in December that there had been a slowdown in domestic demand. Members of the US Federal Reserve and the European Central Bank have indicated they will “stay the course” and continue to raise rates in an effort to tamp inflation.

🎂 Number time!

$2,024 - the average rent in Canada. That’s a 12.4% YoY increase.

1/10 - the percentage of Canadians that do not file taxes.

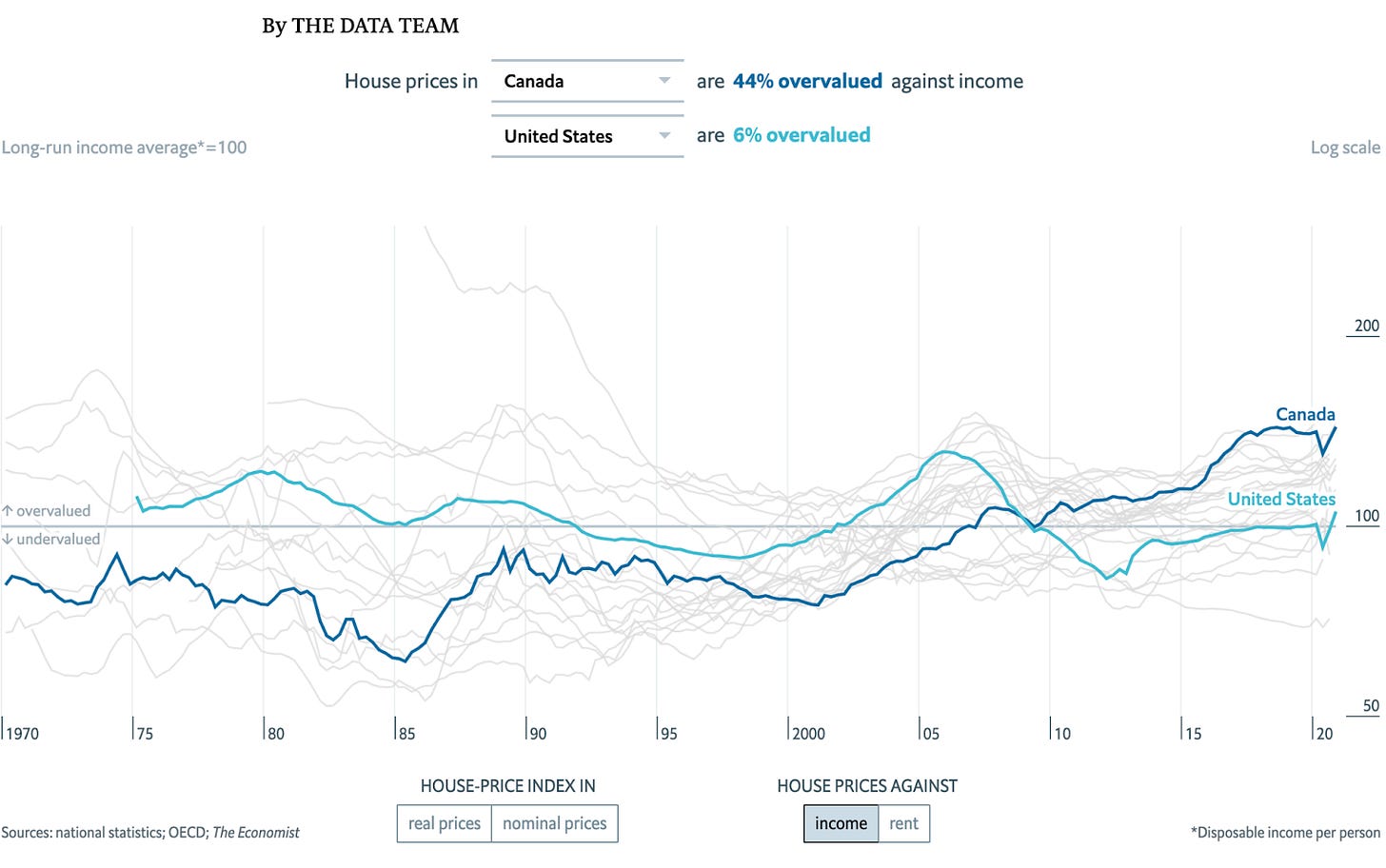

44% - Canadian real estate overvalued against income according to The Economist (see graph).

👀 Who’s hiring?

Iceberg Finance, Business Development Manager (London)

Iceberg Finance, Business Development Manager (Vancouver)

Google, Chrome Payments Product Manager (Montreal)

Brex, Credit Science & Underwriting (Remote)

As always, thank you for letting me appear in your inbox twice a month!

Interested in sponsoring? Reply to this email.

Thanks for the mention about Truly Financial. We're helping Canadian and U.S. businesses get access to international bank accounts and international payments so they can do business globally without the constraints of traditional banks.

The business banking space is exploding in Canada and it's great to see new products being launched. I predict 2023 will be the year when we can proudly say that Canadian fintech is going mainstream, though we're still trailing 2-3 years behind the U.S.