Canadian Fintech: Bank of Canada (Post) ✉️

RTR gets delayed... again. Banks love doctors. Why fintechs wants SKU-level data.

Morning,

Welcome back to Canadian Fintech! Was this newsletter forwarded to you? Join the 5,619 others by clicking below. Thanks!

💰 Funding

VeriFast, an identity and income verification platform for mortgage lending and landlord tenant screening raised $3.5m, with strategic investment from one of Canada’s largest mortgage brokers, M3 Financial Group.

Ownly, a sales and marketing platform for real estate developers to identify and convert home buyers raised $2.5m.

Canada Drives, an online car dealership, raised a $10m extension round on equal terms to their $40m strategic investment from goeasy in June.

HelloSafe, a rate comparison marketplace for products like insurance and loans, raised $4.2m. I covered how rate comparison sites work and are monetized here.

Horizon, an all-in-one developer platform and smart wallet for building web3 applications raised $40m. The Canadian company launched in 2017 with card-game Skyweaver and plans to launch niftyswap, a marketplace for semi-fungible tokens.

🤝 M&A

FTX is acquiring assets from bankrupt TSX-listed crypto lender Voyager Digital. FTX has backing from the Ontario Teachers Pension Fund and recently entered Canada by acquiring crypto exchange Bitvo.

Breathe Life, a Montreal based origination software for life insurance and annuity products was acquired by SE2. The combined entity rebranded as Zinnia and provides an end-to-end life & annuity management system.

Montfort Capital, a portfolio of alternative lending brands, acquired Langhaus, Canada’s largest independent provider of insurance policy backed loans. Montfort’s other credit brands include TIMIA (tech), Pivot (small biz), & Brightpath (mortgage).

RBCx acquired medical billing platform MDBilling.ca. RBC acquired a similar company in 2020 - Dr.Bill. Why double down? Physicians are a stable and high income earning client segment that can be cross sold on retail, private wealth, small business, mortgage and insurance services. Big 5’s all want a piece:

Scotia acquired MD Financial Management a provider of financial services to doctors, from the Canadian Medical Association for $2.6b in 2018.

TD launched specialized wealth management services for healthcare professionals the same year.

CIBC launched physician specialized offerings across business and personal banking in 2019.

Sensibill, software that allows banks and fintechs to digitize customer receipts was acquired by digital banking platform Q2. In my interview with Jonathan Price (Q2 Corp Dev) and Corey Gross (Sensibill CEO), the two explained that the Q2 acquisition was about giving banks access to more granular data. What does that mean?

Receipts hold SKU-level data ie. what item was purchased

Without it, banks only receive transaction-level data ie. where the item was purchased and for how much

SKU-level + transaction-level data gives banks insight into customer life stage, brand loyalty, values, etc.

Are you a loan originator looking for portfolio financing?

Meet Cypress Hills Partners, one of Canada’s leading funder of lenders:

Financed approximately $200m of loan receivables

Offering higher advance rate structures that allow lenders to reinvest more retained earnings into growth

Specialized in consumer, corporate trade, and other unique collateral pools

Interested in a custom-structured credit facility? Let’s chat!

🚀 Product

Canada Post has partnered with TD to offer loans between $1k - $30k. The product carries no fees; rates between 9.78% to 19.98%; and repayment terms between 1 and 7 years. It is unclear what the commercial relationship is between the crown corp and TD, but this is likely a way for the bank to subsidize branch presence in rural regions of the country. Branches are expensive to maintain and have been closing down consistently in all provinces (see graph)

Prepaid card STACK, already allows users to load cash at 10k Canada Post locations through its partnership with Payment Source.

Arbor now allows Shopify sellers to measure the CO2e impact of the products and showcase them to shoppers. On theme, Vancity, Canada’s largest credit union will let their members track the carbon footprints of their Visa purchases.

Wahi launched their first home auction in the GTA. The auction model reduces seller fees charged by brokers from 2.5% to 0.5%. I’ve written about real estate auction competitor Unreserved here and here.

Nuula, a platform for small businesses to monitor cash flow and access financial products, has let go all employees after their Series A financing fell apart. I’ve written about the fintech’s sophisticated partner network here and here.

⚖️ Policy

Finance Canada has approved Equitable Bank’s takeover of Concentra Bank, making it the 7th largest bank by assets in the country.

Payments Canada has delayed the launch of the Real-Time-Rail (RTR)... again.

But to soften the blow, Payments Canada is recommending that it expand its membership eligibility to:

local credit unions

payment service providers (PSPs)

financial market infrastructure entities.

Coinsquare became Canada’s first crypto IIROC dealer.

In an absurd case of regulatory overreach, tech companies in Alberta are being targeted with lawsuits over their use of the job title “software engineer”. APEGA, Alberta’s engineering trade association, is making the case that if fintechs want to hire software engineers, then those engineers must be regulated and subject to strict certification requirements… like geoscientists who drill for lithium 🤯

Find out at The Peak's Bet on Canada Summit on November 8th. I’ll be moderating a session with the CEO’s of Homewise, Felix, and Eirene.

🎂 Number time!

13% - the fraction of Canadians who hold bitcoin according to the Bank of Canada

1st - the world rank of Toronto for the largest real estate bubble according to UBS

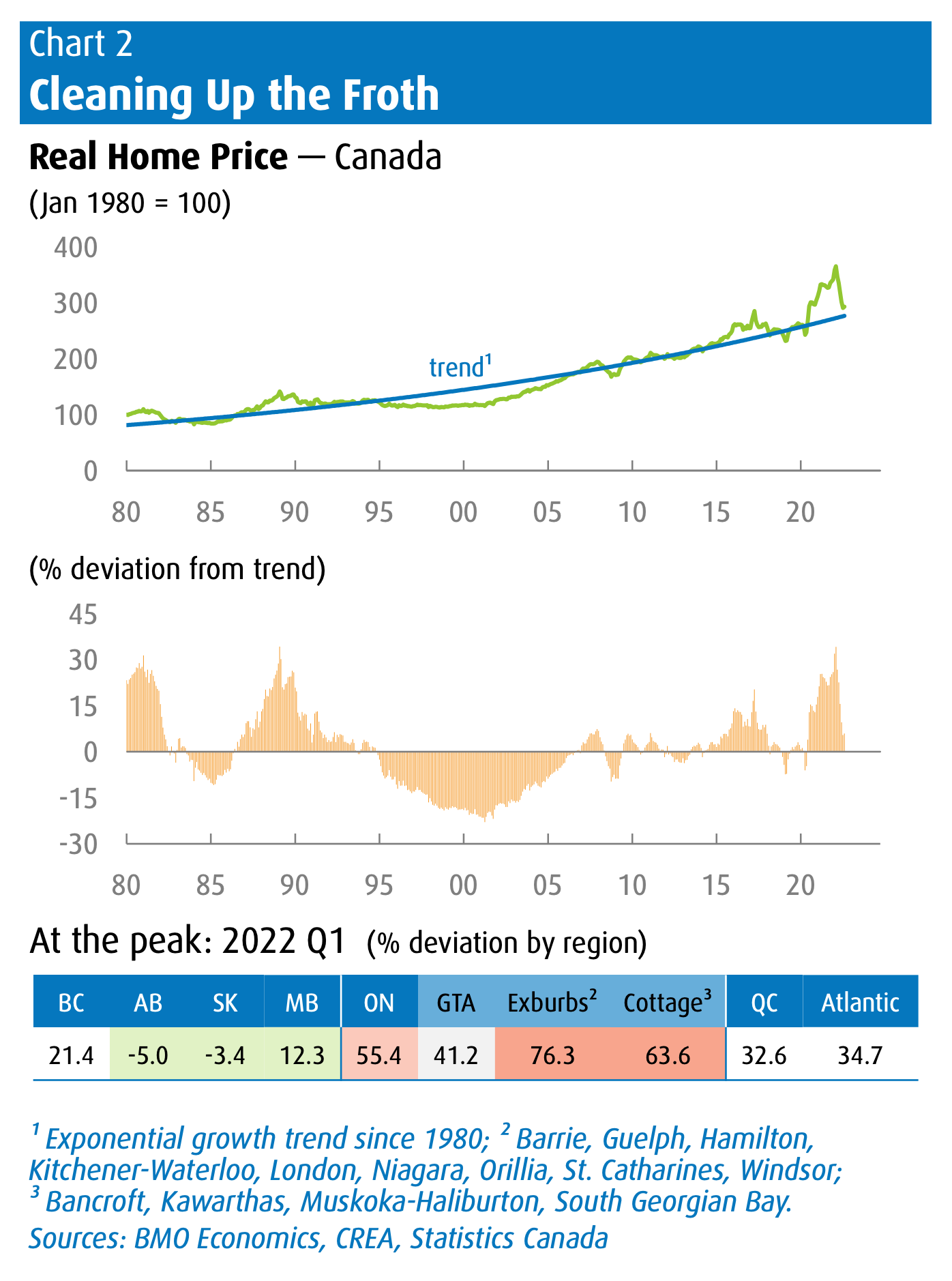

76% - the deviation from the price trend line (which is roughly 3% / year) for Toronto Exburbs (Barrie, London, Windsor, etc.) real estate in Q1 2022 (see graph below)... UBS might be onto something 🧐

👀 Who’s hiring?

EQ Bank, Group Product Manager (Toronto)

Plaid, Account Executive (Remote)

Neo Financial, Director of Credit Risk (Calgary)

Thanks for reading to the end!

I have a question for you. Would you prefer to receive:

a shorter newsletter once a week, or

the same length of newsletter every two weeks (this is what I do now)

Thanks! 👋

Interested in sponsoring? Reply to this email.

I would like weekly newsletters!

I like the longer newsletter every two weeks!