Canadian Fintech: Koho Loss Rates vs Big 5 Banks 🙀

Pension fund 🤦... again. Crypto exchanges diversify. Corp cards go international.

Morning!

Welcome back to Canadian Fintech, a newsletter for financial services operators. Was this email forwarded to you? Become one of our 5,697 subscribers by clicking below.

💰 Funding

Uplinq, underwriting software for small business lenders raised $1.6m, building on their $4.4m round in the Spring. Judi.ai is another Canadian vendor in this market.

Fintech lenders are re-upping:

Online travel agency Hopper raised $120m from strategic investor Capital One valuing the company at over $6b. Hopper’s b2b offering (of which Capital One is a client) represents 40% of their business.

Online mortgage broker Perch raised $4m to provide a suite of payment calculators for home buyers.

Coming out of a rocky period for dining, restaurant POS TouchBistro has raised $150m. Truffle, a smaller Edmonton competitor, raised $2m earlier this year.

Blossom Social, a social stock trading platform raised $750k to become the eToro of Canada. They expect to receive approval from IIROC to become an investment dealer (aka a brokerage) next year.

🤝 M&A

Ontario Teachers Pension Plan is likely to lose 0.05% of net assets thanks to a $120m investment in FTX, the recently bankrupted crypto exchange. Deja vu? Canada’s second largest pension fund, CDPQ also lost its $190m investment in Celsius, a crypto lender that went under in June.

Construction industry payments provider MazumaGo has sold its Canadian operations to Vancouver based Baseline Payments. I wrote about the company previously here and here.

Heavy equipment auctioneer, Ritchie Bros. is entering the vehicle auction market through a $7b acquisition of IAA.

Cox Automotive has sold its Canadian digital retail business lines (Dealertrack, VinSolutions, Dealer.com, Xtime and Kelley Blue Book) to AutoTrader.

🚀 Product

Canadian corporate cards are going international:

Crypto exchanges are expanding their offerings:

Black Opportunity Fund has launched its Black Entrepreneur Loan Program, an inclusive lending program for Black Entrepreneurs. TD committed to $10m to the fund in 2021.

Do you have the data you need to assess risk accurately?

We have a data problem: we’re constantly gathering data, but it’s a challenge for anyone to actually use it. That’s why if you’re like 75% of your peers, you can’t access the data you need for accurate decisioning.

The secret to smarter decisions? It’s not more data, it’s the right data.

Learn more about how the right technology can get you any data, anywhere, on-demand.

Koho Loss Rates vs Big 5 Banks

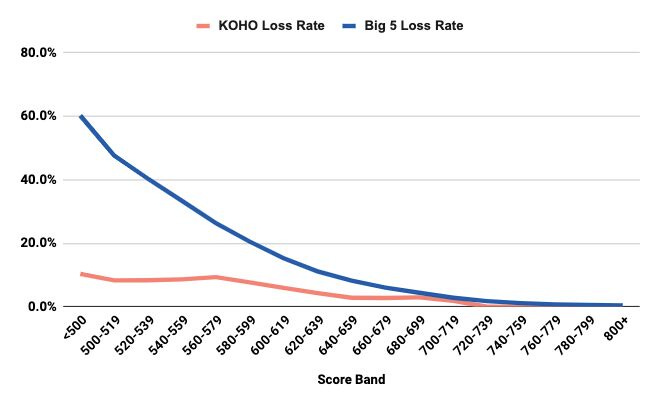

Daniel Eberhard, CEO of Koho temporarily broke the internet (okay just my Linkedin newsfeed) with the graph below.

It depicts Koho’s loss rates at 6x lower than banks for borrowers with <500 FICOs. FICO is a popular credit scorer used by many lenders.

What do loss rates and interest rates have to do with each other?

Lenders need to price losses into what they charge on loans. If they expect higher losses on a specific segment, they’ll charge higher rates to compensate.

The average Canadian has a 670 FICO, suggesting that if a bank is using risk-based pricing (higher interest rates for lower FICO scores) then many Canadians are being overcharged for their borrowing.

What’s the issue here?

Credit scoring (as I’ve written about here) is a measurement of credit worthiness based primarily on a borrower's history with other loans. Has a borrower historically paid off their loans on time? How long have they used credit for? How many different credit products do they have? Etc.

The big problem: what if a Canadian doesn’t have any history with loans:

They’ve been too young to get loans

They’re a recent immigrant to Canada with no local credit history

They’ve rented their entire life instead of paying off a mortgage

Traditional credit scorers struggle to accurately score these segments, often referred to as “credit invisibles”. If a borrower is “invisible” that effectively means that they’re risky to lend to, which means they’re going to receive a higher interest rate, or no loan at all.

So how do you make the invisible visible? You look at non-credit data like telephone bills, rental payments, utility bills, cash flow data, and even social media data.

So here is Koho’s argument:

Koho is better able to underwrite <500 FICO borrowers (find the invisible primes), because they are looking at data beyond FICO, and have determined that these borrowers aren’t as risky as the banks say they are.

BUT… and these are big buts:

FICO is not perfect, but it is a strong determinant of credit worthiness

Alternative data like cash flow tells a lender about a borrower’s capacity to pay, not their willingness to pay

Banks are compelled to use credit scores for compliance reasons

The study was conducted across 10s of thousands of loans, not millions.

🎂 Number time!

43% - the percentage of employees laid off at RenoRun. The home improvement marketplace announced a $181m financing round in Feb

$2,121 - the average Canadian credit card debt according to Equifax. This is a record high

“Close to 0” - expected economic growth until next summer according to Bank of Canada Governor Tiff Macklem

👀 Who’s hiring?

Symend, Senior Product Manager (Calgary)

Shopify, Product Operations Lead (Toronto)

Simplii, Director Product Management (Toronto)

💡 Fintech Events

Canadian Lenders Summit - the largest fintech and lending event in the country. I’ll be on stage speaking about credit risk and fraud. Use promocode CanadianFintechNewsletter for 15% off afternoon tickets.

Interested in sponsoring? Reply to this email.