Canadian Fintech: Predictions for 2023 🔮

Nesto goes b2b. Why embed fintech? Symcor makes a play for open banking.

Happy new year!

Welcome back to the Canadian Fintech Newsletter. Was this forwarded to you? Become one of our 6,270 subscribers by clicking below.

💰 Funding

Plooto an account receivable / accounts payable automation platform for SMBs raised $27m.

Two models are starting to emerge in Canadian small business accounting, banking and payments. “The Specialists”, like Plooto and Xero that do one of these things well and focus on integrations between providers. And “The Generalists”, like Wave and Pillar, that consolidate all of these into one platform, and don't play nice with other providers.

Nesto an online mortgage lender, raised $80m and announced that it will start white-labeling its origination and servicing technology for other banks and credit unions.

Technology is the ultimate advantage in bank lending. There are two main cost centers for lenders: cost of operations (originating & servicing loans) and cost of capital (how much a lender pays for the funds they lend out). Banks and CUs have insanely low cost of capital because they hold customer deposits, but very high cost of operations because they are not technology organizations.

Fintel Connect an affiliate marketing platform that connects publishers with financial service providers raised under $5m.

Where things get interesting in finserv marketing is compliance. Let’s say you're the head of mortgage product at TD, offering a 6% 5 year fixed closed mortgage and waiving appraisal fees until the end of the month. What happens if the prime rate increases but the advert still shows the lower rate? What happens if the campaign ends but the advert is still being shown? Or worse yet, what happens if different adverts are showing different prices 😬. Bank offer management requires continual compliance monitoring and typically rely on enterprise tools like Nomis, Zafin and Naehas.

Walnut raised $4m to help other companies offer insurance products.

Embedded fintech is the ultimate “bolt-on” product. Want to offer lending? Use Sivo. Want to offer wealth management? Use OneVest. Want to offer earned-wage- access? Use Payfare. Payroll, banking, financing, loyalty programs, you-name-it can be embedded into customer experiences. Why? Brands get to market quickly with a new source of revenue, without taking on the risk of regulatory management and technology maintenance.

🤝 M&A

Investment platform Delphia acquired Fathom Privacy. Why?

Delphia is an algorithmic trading platform that uses tons of user permissioned data (browsing, social, shopping, etc.) to train their models. Fathom lets users share their data through a single API. Build < buy.

Subprime lender Everyday People acquired General Credit Services. Why?

Everyday People offers secured credit cards, credit builder loans and lease-to-own homes targeting new-to-canada and bruised credit borrowers. GCS is a debt collections agency. It’s unclear if this acquisition was to bolster EP’s internal collection team, or to build out their b2b offering.

🚀 Product

BMO Business Banking has partnered with Extend to allow their credit card holders to issue virtual cards.

Think of this as white-labeled Float, Jeeves or Caary on top of your existing bank credit card program.

In other business banking news, CWB has partnered with Brim to offer business credit cards.

CWB was already working with Brim on personal credit cards, but this is much more significant as the bank’s core focus is business banking. Brim is one of the only non-bank issuers in the country.

Beaver Bitcoin, a service to automate weekly purchases of bitcoin to a self custody wallet launched. Wealthsimple offers the same feature, but only through their custodial wallet.

CPP, Canada’s largest pension fund will end all crypto research and investment. Why? Two other pension plans, Ontario Teachers and CDPQ, took large losses on FTX and Celsius.

Symcor a large vendor to Canadian banks, has launched an open banking service that will allow banks to share customer data with 3rd parties.

Although few details have been provided, open banking is set to take effect in early 2023, so the timing of this announcement is important. Symcor is very well positioned to make a play for the ‘de facto open banking tech platform’ because 1) they are already used by most banks for other data sharing use cases and 2) they are owned by TD, BMO, and RBC which will keep control firmly in the hands of banks.

Are you an auto or equipment lender? It’s time to meet NETSOL.

NETSOL has been proudly serving the global automotive and equipment finance and leasing industry for over four decades.

Our premier platform, NFS Ascent, is a proven, highly adaptive, and unrivalled modern technology solution available on the Cloud via flexible, subscription-based pricing, rapid deployment, and the ability to scale on demand.

Ascent covers Point-of-Sale, Origination and Servicing business processes.

⚖️ Policy

Bitbuy has gained regulatory approval to offer crypto staking. What is staking? It’s where crypto holders agree to lockup tokens for a period of time to participate in the blockchain network in return for more crypto. Wealthsimple was the first to be approved.

“Following recent events in the crypto market”, the Canadian Securities Administrator (CSA) is strengthening oversight of crypto trading firms. These are biggies:

Unregistered trading platforms that are pursuing registration, must complete a pre-registration undertaking (PRU). In other words… “comply before you apply”.

Exchanges must have client assets held by an appropriate custodian and these assets need to be segregated from the platform’s proprietary business. In other words… don’t do an FTX.

Total prohibition against trading platforms offering margin or leverage for any Canadian client.

CSA believes stablecoins may constitute securities and/or derivatives. Why does this matter? Exchanges are not allowed to list securities or derivatives.

In an epic blast from the past, Quadriga CX is back in the news. Once Canada’s largest crypto exchange, the firm went belly up after the reported death of founder Gerald Cotten - the only person with access to millions in customer funds. This month, more than 100 bitcoins tied to Quadriga were moved 👻.

🔮 5 Canadian Fintech Predictions for 2023

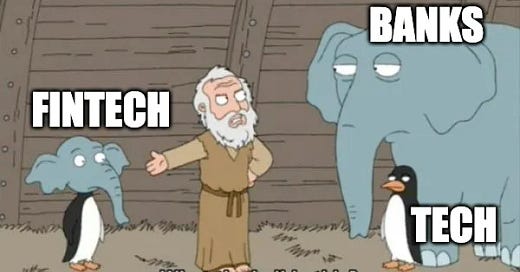

1. More banks & credit unions will offer BaaS

Banking-as-a-Service (Baas), describes a commercial partnership between regulated financial institutions and fintechs:

Banks - provide their licenses for things like card issuing and CDIC

Fintechs - use that license to build their own products

Today most BaaS is provided by two banks: Peoples Group and Digital Commerce Bank. They power fintechs like Koho, Vault, Pillar, Mogo, etc.

I predict a new cohort of credit unions and tier 2 banks will begin offering BaaS and new leaders will emerge. My money's on Equitable Bank thanks to their acquisition of Concentra.

2. Banks will do mass layoffs

What goes up must come down. Last year banks quickly scaled up headcount:

National, RBC, Laurentian, CIBC increased staff by ~10%

TD & BMO increased by ~5%

In the five previous years this number was ~1% per year.

I predict a sharp uptick in layoffs and return to the trailing average.

3. More fintech for SMBs

Consumer fintech was the undisputed champ of the pandemic.

Government stimulus was burning a hole in Canadian consumer’s pockets, leading to a surge in discretionary spending and retail investing. That led to gigantic financing rounds for Canadian fintechs like Koho, Neo & Affirm and made these fintechs household names.

I predict that 2023 will be the year that similar brands emerge for SMB fintechs.

Look out for these trends:

Business BNPL -> Tabit & NetNow

Business Banking -> Vault & Pillar

Business Cards -> Float & Jeeves

4. Continued M&A in the mortgage industry

There has been a HUGE amount of consolidation in the mortgage industry:

OTPP acquired HomeEquity Bank.

Smith Financial acquired Home Capital.

MCAP acquired competitors Paradigm Quest and Merix.

RBC acquired HSBC.

I predict this trend will continue. Why?

Organic growth has slowed across the mortgage industry. Rates are up and home sales are down.

Inorganic growth (buying other lenders) is the fastest way to grow profitably right now.

5. Treasury management fintech

High rates puts pressure on SMBs:

Existing debt becomes more expensive to service, putting a wet rag on cash flow and profitability.

Finding new affordable debt becomes harder, making it tough to expand.

So businesses start to cut costs to become more profitable at the expense of growth.

But what about war-time revenue generating measures? If a business has a bunch of cash sitting in the bank, why can’t they collect a solid yield on their corporate treasury and benefit from a rise in rates like large corporates do?

I predict fintechs will offer SMB treasury management services this year that make it easier to purchase short and long term investment products - GICs, bonds, equities, etc.

As always, thank you for letting me appear in your inbox twice a month! Today this newsletter turns 1! So happy birthday to me and happy new year to all of you 🥳

Interested in sponsoring? Reply to this email.