Canadian Fintech: Robinhood enters Canada 🏹

Stablecorp raises from Coinbase. Wealthsimple & Propel hit new records.

Good morning! Welcome back to the Canadian Fintech Newsletter, an industry roundup for founders, operators and investors.

Every Monday we break down the hottest topics in the industry in under 3 minutes.

This month I was interviewed at the Payments Canada Summit by Betakit for my thoughts on Carney’s fintech track record.

Also, I’ll be in Calgary this week speaking at Inventures. If you’re in the hood, come say hi!

Was this forwarded to you? Become one of our 12,796 subscribers by clicking below.

💰 Funding

Novisto, a software that helps companies compile and report ESG data to shareholders, expanded to Europe and raised $38m led by Inovia.

The firm raised $20m in 2023.

Una Software, a Toronto based fp&a platform raised $6m led by Staircase Ventures.

The fintech raised $7.5m last December.

Stablecorp, a Toronto based stablecoin pegged to the Canadian dollar, raised $2.5m led by Coinbase.

You can catch both of these companies speaking at the Canadian Finance Summit on June 2nd.

🤝 M&A

WonderFi, a Toronto based crypto exchange was acquired by Robinhood, a major US stock trading app for $250m. Why?

WonderFi is a rollup of several Canadian crypto exchanges: Bitvo, Coinberry, BitBuy & Coinsquare. This gives Robinhood over 2m Canadian clients.

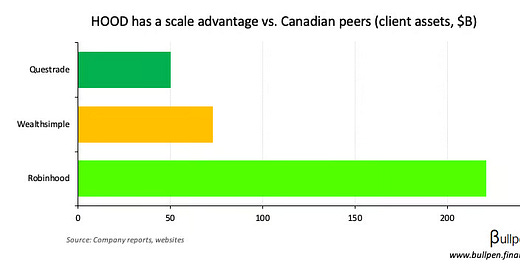

WonderFi’s investment dealer licenses will allow Robinhood to eventually roll out traditional online brokerage services and compete with Wealthsimple & Questrade. Robinhood has 3x the assets of both companies.

A MESSAGE FROM COLLECTR

💸 How 4m people are making money selling collectibles

The cards you loved as a kid might pay off as an adult. Nostalgia just got valuable. Download Collectr — the world’s largest collectibles app.

🚀 Product

Wealthsimple crossed $73b in AUM, up from $31b at the end of 2023.

MPOWER, a US based student lender completed the first ever securitization of international student loans to Canadian students.

Propel Holdings, a Toronto based consumer lender, hit $139m in revenue in Q1, up 44% YoY.

The majority of Propel’s book is in the US. The company entered the Canadian market in 2023.

Tetra, a Calgary based crypto custodian launched an orchestration platform, allowing their customers to pick and choose their vendors for settlement, execution & compliance.

Interpolitan Money, a UK based multi-currency account provider, entered Canada.

ICICI Bank high-net-worth clients can now get wealth management services from Scotiabank.

⚖️ Policy

Crypto.com, a US crypto exchange, received a Canadian restricted dealer license.

This allows them to operate while they apply for a full dealer license and membership to CIRO.

Ontario based credit unions will soon be allowed to raise capital outside of their membership by selling investment shares to non-members.

This makes them more competitive banks and fintechs.

The announcement came in the Ontario 2025 Budget.

Raising money for your fintech? Fill out this form

Want to invest in Canadian fintech? Fill out this form

Want to get in front of 12,796 fintech decision makers? Reply to this email to become a sponsor.

Have a great week! See ya 👋