Canadian Fintech: The History of Hopper 🐰

Bank earnings as told in emojis. PolicyMe does it again!

Good morning!

Welcome back to the Canadian Fintech Newsletter, an industry roundup for founders, operators and investors. Every Monday we break down the hottest topics in the industry in under 3 minutes.

If you’re looking for something to listen to this week, I was interviewed on the Fintech Layer Cake Podcast. It’s short and full of my Canadian fintech shticks.

Was this forwarded to you? Become one of our 11,500 subscribers by clicking below.

💰 Funding

PolicyMe, an online insurance platform launched a life insurance product underwritten by Blue Cross Life, a Saskatoon based insurer. Blue Cross will also invest $15m into PolicyMe as a part of the deal.

Sounds familiar? That’s because PolicyMe ran this exact same play back in 2022: PolicyMe launched a product underwritten by Securian, who ALSO invested in the company.

Laurentian Bank is looking for about $1b in funding for Northpoint Commercial Finance, an equipment lender it owns.

The bank has had a few hiccups this year as I’ve written about several times.

In response, Laurentian has been selling off non-core businesses like its brokerage units in order to double down on commercial finance, a profit centre for the bank.

🚀 Product

Mantle, a tool for startups to manage their cap tables, launched a product that instead targets startup investors.

The product allows investors to see all of the private investments in one place in order to manage their capital calls, tax documents, and performance across assets.

Other cap table management softwares like Carta have also built products that target both startups and their investors.

Homewise recently launched partnerships with Credit Karma and ClearScore, to become their embedded mortgage solution.

Conquest Planning, a Winnipeg based financial planning software crossed $1m financial plans created.

Questrade is winding down the mortgage product that they launched in 2022.

Cohere, a Toronto based AI company is building a multibillion dollar data centre in Canada.

The federal government is chipping in $240m as part of their $700m fund dedicated to finance AI infrastructure in Canada.

Hopper, the Montreal based travel tech company is pivoting… again.

In 2007 ex-Expedia employees launched Hopper, a travel content site. It was basically an aggregator of travel blogs.

In 2014 Hopper published a piece on the best time to book cheap flights. The article drove 100x more traffic than the previous four years combined.

In 2015 Hopper pivoted into travel booking and cut 50% of their team. They launched a consumer app that notified travelers of the best times to book their trips.

In 2021 Hopper launched b2b “travel fintech” products like flight insurance, price freezing, and price drop guarantee that were embedded into third parties like Air Canada, Uber, Kayak & Capital One.

Today, Hopper’s b2b business represents ⅔ of its revenue. The company recently announced it was cutting 30-40% of its team to focus on the opportunity.

Pivoting as a startup is expected. But pivoting while doing over $700m in revenue is remarkable. Love this story!

A MESSAGE FROM FINANCE EVENTS

🏎️ Automotive Finance is back in the drivers seat…

Early bird tickets for Canada’s largest automotive finance conference are on sale now!

Join hundreds of banks and fintechs for a full day conference in partnership with the Canadian Auto Show.

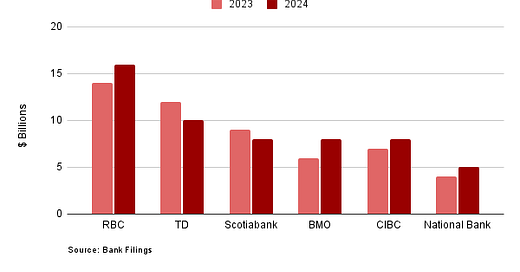

🏦 Bank earnings… as told in emojis

Best described as a mixed bag. Every bank was impacted by increases in their loan loss reserves. But some fared far better than others.

BMO (beat) 🥳

BMO had the largest increase in credit loss reserves, but signalled the worst was now behind them.

CIBC (beat) 🤩

CIBC finally sold off $446m of poorly performing US office loans, which had been a drag on earnings.

RBC (beat) ☺️

RBC got a nice little bump from its HSBC assets.

National Bank (beat) 😐

Investors are still trying to figure out the impacts of the CWB acquisition.

Credit performance was a bit worse than expected.

Scotiabank (miss) 🙄

The bank wrote down a $379m investment in China’s Bank of Xi’an, which has been struggling due to a slowing Chinese economy.

TD (miss) 🫠

The bank is still reeling from a USD $3b fine for its money laundering scandal.

Profit grew overall but its US retail banking income dropped ⅓ over the last year.

⚖️ Policy

The Bank of Canada published a list of payment service companies that registered under RPAA.

Some big names were notably missing like Apple and Meta.

Raising money for your fintech? Fill out this form

Want to invest in Canadian fintech? Fill out this form

Want to get in front of 11,500 fintech decision makers? Reply to this email to become a sponsor.

Have a great week! See ya 👋