Canadian Fintech: Why did Pine buy Properly? 🌲

Wealthsimple gets into mortgages. Interac expands to fintechs. Clearco raises money.

Morning!

Welcome back to Canadian Fintech, a newsletter for founders, operators & investors. For those of you interested in banking & lending, I’ll be co-hosting the Canadian Lenders Summit on Nov 1st in Toronto. Use code canadianfintech.org for a 20% discount.

Was this forwarded to you? Become one of our 7,570 subscribers by clicking below.

💰 Funding

Clearco, the og e-com lender, has gone through a financial restructuring, which values the company at $200m USD post money. Two years ago they were valued at $2b.

The lender is also pivoting away from revenue based financing to focus on invoice factoring.

Speaking of invoice factoring… Quickly, a b2b receivables financing platform raised $10m in debt & equity.

🤝 M&A

Pine, a digital mortgage lender acquired Properly, a real estate broker and search platform. This was not the exit I wanted for Properly, but I think it’s a great one for Pine. Here’s why:

Price: last newsletter I wrote about why Properly likely sold at a discount. Turns out I was right. Compass purchased their non-broker assets for $32m. My guess is that Pine purchased the rest at far less than that.

CAC: acquiring a customer who is looking for a mortgage is incredibly competitive. Acquiring a customer who is thinking about selling their home is a little more affordable. Properly gets Pine in front of customers way earlier.

RBC figured this out with their acquisition of OJO earlier this year.

Team: although the product ultimately flopped, everyone in fintech knows that Properly has a killer leadership team with deep mortgage expertise

Brand: hey… it’s a pretty great name and those Property Brothers billboards didn’t hurt.

Love filling out expense reports or chasing team members for receipts?

We didn’t think so.

Float is simplifying spend for Canadian companies and teams with our smart corporate cards paired with spend management software.

Discover the difference with Float at www.floatcard.com.

🚀 Product

Interac e-Transfer, a money transfer system used by 280 Canadian financial institutions has expanded access to FINTRAC regulated Money Service Businesses (MSBs) and CIRO regulated investment dealers. This means fintechs can use the payment system directly instead of going through an intermediary partner (bank).

Wealthsimple was the first investment dealer to receive approval to join. Which is interesting because 3 years ago, they tried launching their own p2p payment product to compete with Interac.

Wealthsimple is getting into mortgage lending… kinda. They started running referral campaigns to Nesto and Pine. Wealthsimple shares the same investors as Nesto (Portage) and Pine (Inovia).

Visa announced that it will offer SMB credit scoring to their clients (issuing banks) through Uplinq.

Banks have historically stayed away from SMB lending because they find it difficult to underwrite borrowers with no collateral. Most lenders in this space (Ondeck, Merchant Growth, Driven) primarily lend against a business’s cash flows.

This partnership may signal that at least Visa believes their clients (banks) want to become more active in the SMB lending market.

KOHO users can now fund their cards using digital Canadian dollars (QCAD) through a partnership with Grapes, an on-chain FX system.

📈 Stat of the week

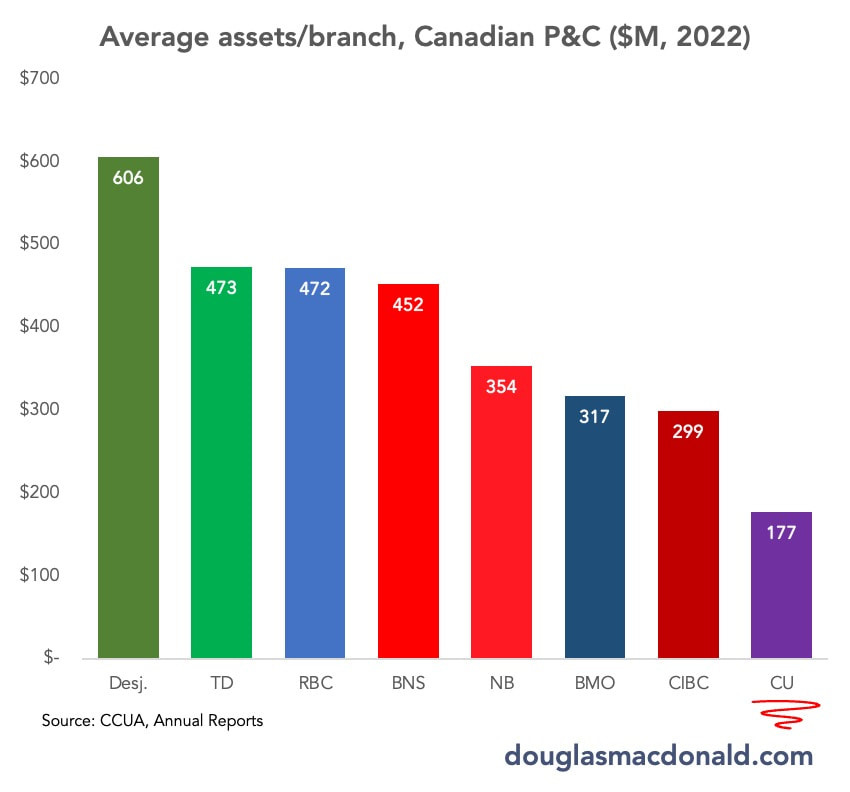

The avg bank branch manages twice as many assets as the avg credit union branch (excluding Desjardins).

Raising money? Get in front of hundreds of Canadian fintech investors here.

Investing? Get access to top Canadian fintech deal flow here.

Interested in newsletter sponsorship? Reply to this email.

Have a great week! See ya 👋

Your posts are fantastic!