Canadian Fintech: Why did Properly get acquired? 🏚️

BMO exits auto finance market. Open banking lead stepping down. ZayZoon rakes it in.

Morning!

Welcome back to Canadian Fintech, a newsletter for founders, operators & investors. Was this forwarded to you? Become one of our 7,414 subscribers by clicking below.

💰 Funding

ZayZoon, a Calgary based earned wage access (EWA) platform raised $34m. ZayZoon partners with employers to allow employees to receive a portion of their salaries in between pay cycles.

Klaviyo a (not Canadian) marketing automation platform IPO’d. Their largest shareholder is Shopify a (very Canadian) e-com platform whose customers drive 75% of Klaviyos’s revenue.

Shopify is a serial strategic investor in their partners - Bench, Stripe & Affirm are all among them. Shopify even sold off its entire logistics business to Flexport, a company they initially invested in.

🤝 M&A

Properly, a real estate search portal and brokerage was acquired by Compass and an undisclosed Canadian buyer. This was likely not a great outcome. Why?

Properly originally launched as a way to let you buy a new home before selling your existing one. They did this by guaranteeing a sales price and sales date on your home, making it easier for you to get approved for a mortgage with another lender. If the house didn’t sell in 90 days, Properly bought it for a guaranteed price and resold it on the market, giving back any profit to the original seller.

However with rates increasing, homes have taken longer to sell forcing Properly to purchase their client’s homes at the guaranteed price. This led Properly to pivot away from sale assurance earlier this year, and turn their focus towards their home search platform and brokerage business - which is largely undifferentiated from other marketplaces.

Love filling out expense reports or chasing team members for receipts?

We didn’t think so.

Float is simplifying spend for Canadian companies and teams with our smart corporate cards paired with spend management software.

Discover the difference with Float at www.floatcard.com.

🚀 Product

BMO is exiting the US and Canadian indirect consumer auto finance market due to mounting losses and slowing demand. What is indirect auto financing? This is where a car dealership arranges the financing of a vehicle on behalf of a bank.

Canadian banks are known to enter and exit credit sectors throughout market cycles. Once rates stabilize and consumer demand returns, it is likely they will reenter.

BMO will still get exposure to the segment through their specialty finance division, which lends to other auto lenders and also through their commercial auto business, which provides financing to car dealers so that they can purchase inventory.

Square, an e-com payment provider is now servicing the Canadian cannabis industry.

Interesting timing, as Mastercard just instructed US banks to stop allowing purchases of cannabis on its debit cards.

⚖️ Policy

The deadline to repay CEBA, a covid era gov loan to SMBs has been extended to Jan 18th. After that, interest starts accruing at 5%. Only 21% of borrowers had fully repaid loans as of June.

Canada’s Open Banking Lead is expected to end his term this month. However, if it’s anything like his implementation timeline, he’ll probably miss that deadline by several months 🥁

📈 Stat of the week

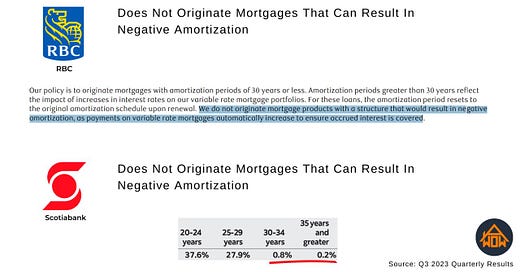

Crazy negative amortization numbers from big banks' Q3 2023 reports (see image).

Negative amortization is when mortgage payments cannot cover the interest. This happens to variable mortgages with fixed payments when interest rates go up quickly.

👀 Who’s hiring?

MPOWER, Sr Product Manager (Remote / Eastern Canada)

Relay, IT Lead (Toronto)

Kraken, Regulatory Report (Remote)

Are you raising? Get in front of hundreds of Canadian fintech investors here.

Are you investing? Get access to top Canadian fintech deal flow here.

Did you just raise? Put that cash to work with the best GIC rates in Canada here.

Interested in sponsoring? Reply to this email.

Have a great week! See ya 👋