Canadian Fintech: Honk if you hodl 🚚

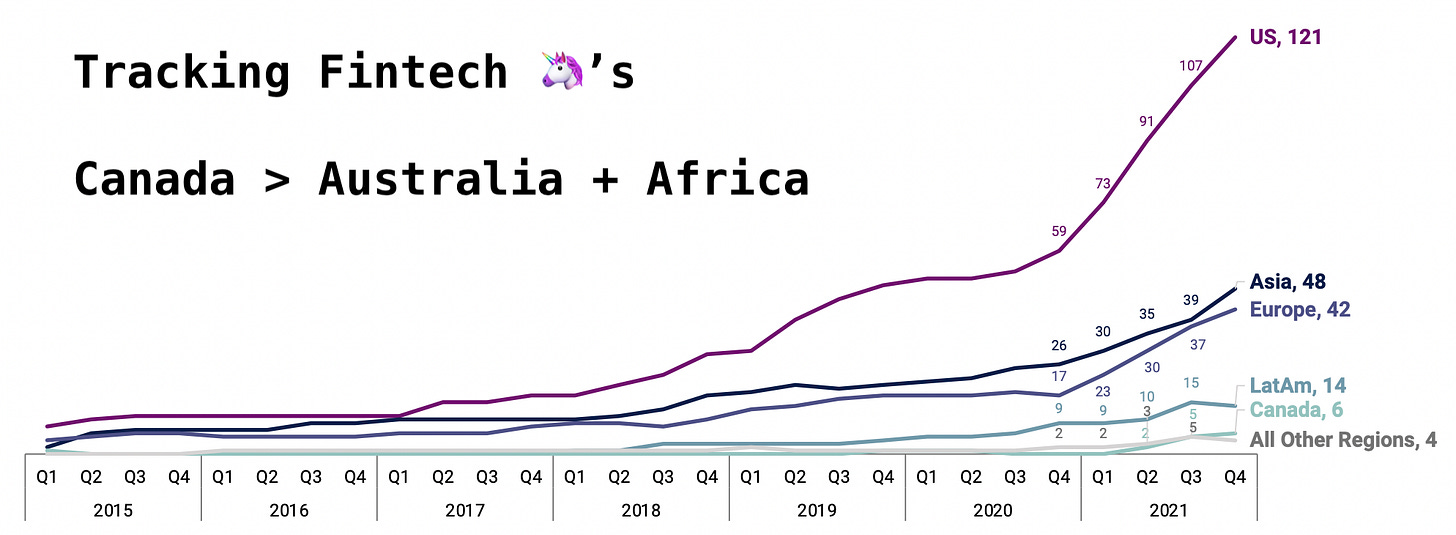

Estate planning is kinda hot right now? B2B BNPL. Canada's unicorns in context.

Morning!

Welcome back to Canadian Fintech, a monthly recap on fintech, lending and banking. If you're reading this and haven't signed up, join the 4,202 others by clicking below. Thanks!

— Tal 👋

💰 Funding

In one of Canada’s all time largest fintech funding announcements, Koho raised $210m putting the neo bank just shy of unicorn status. Koho is a pro at following the “neo-bank playbook” perfected by Chime, Revolut and Monzo:

Step 1) money-in with fee-free high interest savings accounts.

Step 2) money-out through highly profitable, low credit risk products like earned-wage-access and credit building.

Estate planning is… kinda hot right now? ClearEstate raised $16.8m for their end of life asset management platform. While will-generating platform Willful raised $750k on Dragons Den last year.

Hopper, the Montreal based travel app is now valued at $6.4b after investment from Brookfield Asset Management. What’s fintech about this? Hopper is embedding “travel fintech” products like flight insurance, price freezing, and price drop guarantees into third parties like Capital One and Kayak.

🤝 Acquisitions

It’s a good time to be in home improvement lending! One of Canada’s largest home improvement lenders, Financeit, was acquired by the Sovereign Wealth Fund of Kuwait for $350m - $500m. While RenoRun, a platform for contractors to purchase and finance building materials raised $181m to expand into the US.

Equitable is now Canada’s 7th largest bank after acquiring Saskatoon-based Concentra Bank for $470m. Equitable is a digital-only challenger bank that has aggressively grown it’s mortgage portfolio thanks in part to its partnership with Nesto, a broker marketplace. The acquisition also gives Equitable a foothold in the credit union market, as Concentra provides treasury and trust services to 240 credit unions.

🚀 Product

Willow, a rental property investing startup, came out of stealth. Is this a REIT? Not quite, real-estate-investment-trusts are structured as funds whereas Willow allows you to have fractional ownership of a specific property. Sounds like Arrived Homes? Close, but Willow also has a secondary market so you’re not locked into properties until they're sold. Willow lets you offload your shares to other users anytime, similar to what Masterworks has done for the art market.

Levr, a commercial loan origination platform for brokers, lenders and business owners launched in Vancouver.

Wow, that escalated quickly… Canadian metaverse land developer TerraZero Technologies is now offering mortgages to accelerate construction in Decentraland. Digital real estate prices rose 700% last year.

Lexop, a collections management software for lenders and telcos, is expanding to the US with some fresh funding. They'll be joined down south by Fraction, the Vancouver based home equity lender.

Klarna officially launched in Canada and will be hiring 500 technical roles in their Toronto office. The BNPL is also targeting a $50-60 billion valuation in their upcoming round.

Who says BNPL is just for e-com? Tabit launched as Canada’s first B2B BNPL provider allowing vendors to offer point-of-sale financing to other businesses. The group behind Tabit is veteran SMB lending fintech Merchant Growth, which raised $4m in equity late last year.

Apple is rolling out “tap to pay”, a feature that allows merchants to turn their iPhones into payment terminals. Why is this Canadian fintech? Because the tech comes from Apple’s $100m acquisition of Montreal based Mobeewave last year. Square and PayPal stock sank on the news :(

🧑 People:

Lightspeed CEO Dax Dasilva resigned after his stock was walloped by US short sellers. Nuvei, a competing Montreal based payments firm was also targeted but has managed to stem the tailspin.

Clearco management switchup. Michele Romanow will be taking over from partner Andrew D’Souza as CEO.

Shopify CEO Tobias Lütke joined the Coinbase board.

CIBC CEO Peter Dodig says that he’s ready for open banking, and asked the federal government to consider both sides of the issue. This is a big rhetorical departure for a big 5 bank.

🚚 Honk if you hodl

What did the trucker convoy have to do with Canadian fintech? Let’s recap:

Truck drivers protesting in Ottawa and along the Ambassador Bridge became an international headline.

Donors in and out of Canada raised $10m on GoFundMe in support of the convoy, before the crowdfunding platform shut down the page and froze funds.

Donors then pivoted to Tallycoin, a crypto crowdfunding platform.

Jesse Powell, CEO of Kraken, one of the world’s biggest crypto exchanges, donated about $40k.

Elon Musk also had something to say.

Trudeau invoked for the very first time the Emergencies Act, requiring banks to freeze accounts linked to the protest without court orders and brought crowdfunding & crypto platforms under “terrorism” financing oversight.

Over $8m was frozen across 200 accounts.

The OSC sent Canadian crypto wallet platform Nunchuk an injunction to freeze assets and disclose info on users. Nuncheck replied:

Crypto, banking, cross-border payments, Elon Musk, this story has it all!

👀 Who’s hiring?

RBC, Manager of Payments and Digital Commerce Strategy (Toronto)

Wealthsimple, Lead Product Manager of Client Platform (Toronto)

Klarna, Sr Product Manager of Payments (Toronto)

Ledn, Product Manager (Toronto)

Hopper, Sr Product Manager of Cloud Fintech (Toronto)

Coinbase, Sr Product Manager (Montreal)

Tweets of the month

See you next month!

Liked what you read? Please forward it to a fintech friend 🤓