Canadian Fintech: Predictions for 2024 🔮

The future of Canadian embedded finance, data aggregation, business banking & more!

Happy new year! Welcome back to Canadian Fintech, a newsletter for founders, operators & investors.

As is tradition, this week I’m sharing my 5 Canadian fintech predictions for the year.

Want to see how I did on last year’s? Click here. Overall, I’d give myself a B+.

If you get value out of this newsletter, please consider supporting it by upgrading to a paid subscription 🥰

Was this email forwarded to you? Become one of our 8,297 subscribers by clicking below.

1. Mortgage originations get vertically integrated

There are 2-3 million mortgages originated every year in Canada according to the CMHC.

Mortgage brokers do 40% of it.

Most lenders getting into this market start out as brokers. It allows them to build their tech and brand, with far less capital and compliance requirements.

Rocket Mortgage, Pine, Nesto and Ratehub all did this.

Now I’m noticing a new lender/broker trend emerging in Canada.

Lenders are acquiring and launching their own real-estate brokerages. It allows lenders to get in front of a home-buyer much earlier in the sales process.

Pine acquired Properly. Questrade acquired Zolo. RBC acquired OJO.

I predict that this m&a trend will pick up in 2024. My money is on Homewise and HouseSigma both being acquired by lenders.

2. AI is coming for accounting

Accounting technology has historically focused on automating manual workflows:

Auvenir streamlined audit and review

Countable is doing it for compilations

Wave auto categorizes transactions

Now with generative AI, a whole new area of accounting can be automated - personalized research and insight generation.

I predict that this year we’ll see AI co-pilot features creep into every major bookkeeping platform.

3. Data aggregators move beyond bank accounts

The fintech industry runs on financial data APIs.

First it was bank account data courtesy of Flinks.

This unlocked huge fintech gains from cash flow loan underwriting to online KYC.

Now we’re seeing the next wave of financial data APIs:

Wealth accounts (Wealthica & SnapTrade)

Crypto accounts (Vezgo)

But what about payroll and benefits accounts?

I predict that a local HR data API will launch before a US-based one takes over the market.

IN PARTNERSHIP WITH SYNCTERA

Synctera’s platform is officially live in Canada! We’re excited to help unlock financial innovation in Canada by enabling businesses to launch amazing banking products.

Our platform provides the technology infrastructure and compliance framework necessary to build, launch, and scale innovative fintech and embedded finance products in Canada.

Using a robust set of APIs, access all of the technology and capabilities you need to launch banking, card, and money movement products tailored to the needs of your unique customers. Once live, efficiently manage and scale your banking product with our Console, set of data and reporting tools, and team of compliance experts.

Learn more and get in touch with our team using the link below.

4. Embedded finance matures

Offering embedded financial services to shoppers has become the default:

Pay-by-bank at checkout (PayDirect & Paramount Commerce)

BNPL at checkout (Paybright & Tabit)

Product warranties at checkout (Walnut)

Travel disruption insurance at checkout (Hopper)

Now way more niche financial services are being embedded:

Accounting software (Teal.dev)

Wealth management (OneVest)

Loans (Fig)

Cards and deposit accounts (Neo & Synctera)

Payroll (The Nmbr Company)

This is definitely going to get even more niche.

The embedded finance products I predict we’ll see in 2024 are:

Corporate treasury accounts. Low risk, highly liquid investment accounts similar to Moment and Atomic in the US.

Corporate deposit accounts. Shopify, Square & Wave all offer deposit accounts in the US, but not Canada.

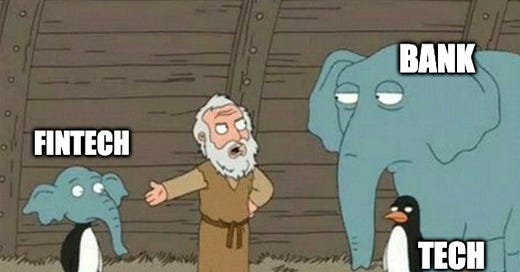

5. The race for business banking will get confusing

Consumer banking in Canada has clear competitors:

Fintechs like Neo, Koho and Wealthsimple

Banks like EQ

On the business banking side it’s less clear:

Fintechs that look like banks (Loop & Vault)

Fintechs that look like corporate cards (Float)

Fintechs that look like AP / AR automation (Plooto, Notch & Procurify)

All offer similar features: online payments, FX, accounting integrations, cards, expense management.

All target similar clients: SMBs.

In 2024 I predict that the lines between them continue to blur as they all build towards a full service business banking solution.

Raising money? Get your deck in front of hundreds of investors here.

Investing? I’ll send you curated fintech deals every week here.

Want to get your brand in front of 8,000+ subscribers? Reply to this email.

Have a great year! See ya 👋